The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

As mentioned, training sessions will be organized to support you in winning this 2nd series of RBC PAC campaign. Don’t miss the first training session on August 5th from 10 to 11am where you could learn how to easily generate new and referred business, as well as a steady stream of recurrent income.

Sign up 30 RBC PACs from September to November 2020 to receive an additional $2,000 bonus. Any PAC amount works! And it’s per account, be it RRSP, TFSA, non-reg, etc. Those who sign up 15 plus but less than 30 RBC PACs will also be rewarded with a lump-sum $750 bonus.

All winners from the 1st series will get first dips and their business will start counting from August 17th.

The PAC strategy is especially beneficial for both clients and advisors in midst of the current volatility. So with advance planning this time, you can surely win some of the extra bonus rewards. Of course, this is not just for the $2,000 but for the long term growth of your business and recurrent income. We will also arrange 1-on-1 trainings to help members win the campaign – send a reply to admin@wayfinancial.ca to indicate your interest in joining and start your PAC business now!

Focus Group on Corporate Cases (September 1 to October 6) – Door Opener Text Templates

Members who have applied to participate in the Focus Group on Corporate Cases are building their client networks by generating interest via text messages on the Health Spending Account (HSA). This is an easy and straightforward way to start talking to those clients with companies on your financial planning service for their corporations.

Reach out to the Administration Department if you would like these text templates as well as to enroll in this Focus Group, which is open without cost to committed members.

| Date

(Time: 10am to 12pm) |

Speaker | Topic |

| Sep 1 | Leon Chan, CPA, BBA,

Wealth & Tax Planning Consultant |

Corporate 101 whiteboard session & insurance planning opportunities |

| Sep 8 | Leon Chan, CPA, BBA

Wealth & Tax Planning Consultant |

Fact finding and optimized discussions with high net worth clients |

| Sep 15 | Jeff Nason, BA, EPC, CHS, CFP, CLU, Advanced Case Consultant

Tim Lau, CFP, CLU, TOT |

Bridging the gap: From Fact-Find to Solution-Selling |

| Sep 22 | Jeff Nason, BA, EPC, CHS, CFP, CLU, Advanced Case Consultant | Corporate Asset Efficiency – Putting the pieces together |

| Sep 29 | Tim Lau, CFP, CLU, TOT | Inter-Generation Tax Saving ITSP

Biggest CII Objection: Is it Worthwhile to Apply if There is No Illness Diagnosed |

| Oct 6 | Patricia Carlos, BA, CHS,

Advanced Planning Strategist, Living Benefits |

Solution Selling: Strategies to Protect the Business Owner |

Carriers’ Updates

Canada Life

Canada Life Weekly Call

Time & Date: 10 to 11am PST, Wednesday, August 5th

Also review the attached CL COVID Update on how to process business, educate your clients and conduct business in the days and weeks to come.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions you may have.

Investment

Further to members’ request on last Friday’s training presentation, attached are the files for your reference. Wholesaler Richard Chen can be reached at richard.chen@canadalife.com or ((604)338-6416 if you have any questions.

Equitable Life

Insurance

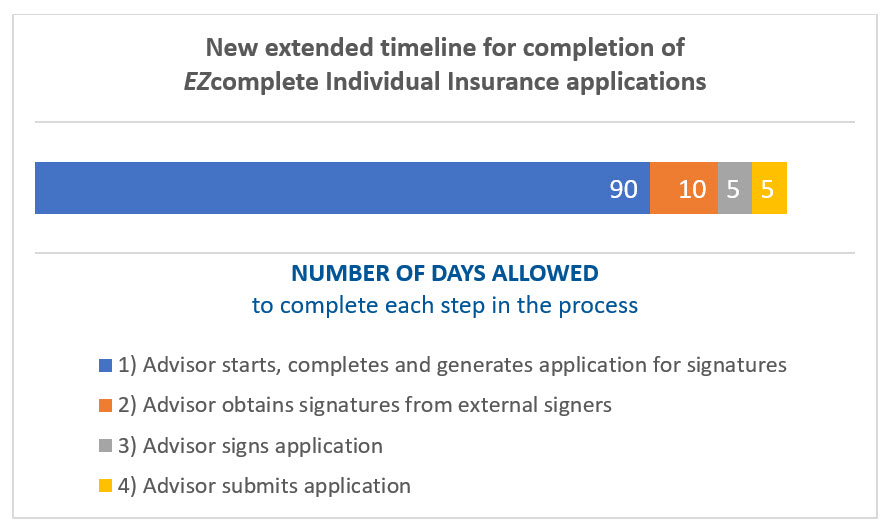

Effective July 25th, 2020, advisors will have more time to complete and obtain the necessary signatures when submitting Individual Insurance applications on EZcomplete.

Click here or contact Monica Zhang at mzhang@equitable.ca or (604)366-4314 for more detailed information.

iA

Insurance

The newest EVO will have the features below:

- iA PAR: Consult and set different tax rates to be applied in your client’s illustration.

- Illustrate projections for coverage amounts up to $90M: Previously set at $10M, the illustration projection amount was increased to $90M. Please note that the premium amount shown is for information purposes only and a special quote request is required.

Two functionalities are once again available:

- Interest rate customization: Customize different interest rates on an annual basis. Interest rate customization is available for each capitalization fund investment account and the portfolio account.

- Customization of term product illustrations: Meet your clients’ term coverage needs based on the desired projection horizon, for each projection separately.

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for more info on the new EVO.

Investment

iA Virtual Summer Tour

Join Clément Gignac, Senior Vice-President and Chief Economist, on his new series of webinars with weekly special guests every Thursday at 8am which run until August 13th.

Webinar #7: Low interest rates and volatility, thanks to central banks!

Time & Date: 8am to 8:30am, Thursday, July 30th

Guest: Alexandre Morin, CFA, Principal Portfolio Manager, Fixed Income Investment Funds, iAIM

TuGo

See the attached PDF TuGo Coverage on a detailed breakdown of how policies work in this COVID-19 situation.

Contact Hélène Desjardins at hdes@tugo.com or 1-800-697-7520 ext. 3501 for any questions you may have.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

CII, Quickpay 10 & Disability Insurance – iA Jackie Singzon

11am, Friday, July 31st

Jackie will tell you about CII and an overview of DI.

Click on the link below to join:

https://us02web.zoom.us/j/85787966757

News from the Insurance Council of British Columbia

LLQP Exams Resume in Vancouver and Victoria

Life Licence Qualification Program (LLQP) exams have resumed in Vancouver location in early June, and registrations are now also being accepted for exams in Victoria. To keep you and exam staff safe, ICBC is following strict physical distancing and other COVID-19 prevention measures.

For more information about how to register for an exam, please visit ICBC COVID-19 Update page.

New Program Will Work with Licensees to Identify Practice Issues Before They Occur

As a part of recently launched Strategic Plan, ICBC will be introducing their Practice Audit Program this fall, which will work directly with licensees to identify and address potential issues before complaints are received, providing feedback and practice guidance to licensees so that they can ensure they are meeting their requirements under the Insurance Council’s Rules and Code of Conduct.

Under the new program, practice audits will be initiated by the Insurance Council through audit requests communicated in advance to licensees. Audits will be selected based on areas of risk identified annually, as well as on a random basis, or on a licensee’s own request.

More detailed information about the Practice Audit Program will be made available in August shortly.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.