The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Presenting to Your Clients with New Lounge TV

Given the frequent usage of the Lounge in client meetings, the office has installed a new TV there to facilitate your effective discussions and presentations.

To project your computer or tablet to the TV, simply do the following:

- Make sure your device is connected to WiFi “Way Connect”

- Press Sources on the TV remote and choose HDMI1/DVI

- On your device, open Google Chrome.

- At the top right, click the three dots button “

” and select Cast.

” and select Cast. - Click Sources and choose whether you want to cast a tab, desktop (your entire screen) or a file.

- Click “Lounge TV” after you select the source.

- When you’ve finished presenting, go to the right of the address bar, click Cast

to stop casting.

to stop casting.

Feel free to reach out to the Administration Department if you have any questions.

Compliance Advice on FNA Submission for Clients Aged 65 or Above

As members already know, an insurance business submission for a child life insured (age 20 and under) does not require an FNA; advisors often include a brief cover letter to indicate the purpose of the insurance instead. This practice can be used for a life insured aged 65 or above. Please do not arbitrarily adjust the FNA template to accommodate the age of someone over 65; a cover letter explaining the client’s situation will be sufficient. The FNA template is designed to meet the compliance rules; manually changing it might make it non-compliant.

If you wish for further advice, please ask Vice President, Compliance & Advisor Development, Stephen, at stephen.lai@wayfinancial.ca or (604) 279-0866 ext. 114 .

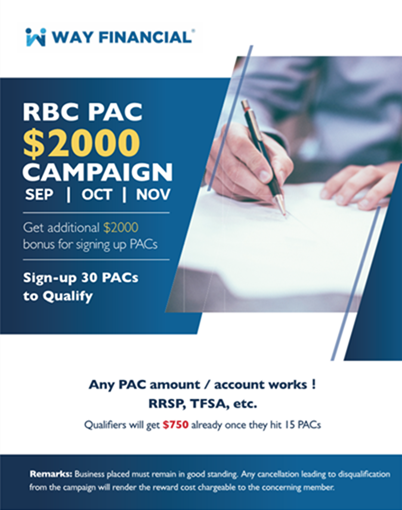

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

Today is the start of the Campaign for winners from the 1st series! Submit your RBC PACs now to enjoy an extra two weeks to count towards the reward.

For the others, sign up 30 RBC PACs from September to November 2020 to receive an additional $2,000 bonus. Any PAC amount works! And it’s per account, be it RRSP, TFSA, non-reg, etc. Those who sign up 15 plus but less than 30 RBC PACs will also be rewarded with a lump-sum $750 bonus.

To help you quickly grasp the benefits of this concept, and how to close cases and be eligible for the bonus, attendance to the upcoming RBC trainings sessions is mandatory. The first training session is from 10 to 11am on September 9th. An advance reward will also be announced then so don’t miss out!

Attached are some text templates for your use to get referrals and new business.

Focus Group on Corporate Cases (September 1 to October 6) – Door Opener Text Templates

We are pleased to announce that Stephanie Carter, Canada Life Underwriting Specialist, will be joining us as a co-speaker presenting on corporate cases and how to financially justify a coverage. Stephanie has been working behind the scenes on many large cases and members could take this opportunity to ask her for tips or any questions related to your own corporate cases.

Members who have applied to participate in the Focus Group on Corporate Cases are building their client networks by generating interest via text messages on the Health Spending Account (HSA). This is an easy and straightforward way to start talking to those clients with companies on your financial planning service for their corporations. Refer to the attached text templates. Reach out to the Administration Department if you would like more text templates as well as to enroll in this Focus Group, which is open without cost to committed members.

Please note that all pre-requisites must be completed by August 28th to secure your spot.

| Date

(Time: 10am to 12pm) |

Speaker | Topic |

| Sep 1 | Leon Chan, CPA, BBA,

Wealth & Tax Planning Consultant Stephanie Carter, RN, BSCN, FALU, FLMI, ACS, ARA, AIRC, ASRI Underwriting Specialist |

Corporate 101 whiteboard session & insurance planning opportunities

Financial Underwriting of Corporate Owned Insurance |

| Sep 8 | Leon Chan, CPA, BBA

Wealth & Tax Planning Consultant |

Fact finding and optimized discussions with high net worth clients |

| Sep 15 | Jeff Nason, BA, EPC, CHS, CFP, CLU, Advanced Case Consultant

Tim Lau, CFP, CLU, TOT |

Bridging the gap: From Fact-Find to Solution-Selling

Inter-Generation Tax Saving ITSP |

| Sep 22 | Jeff Nason, BA, EPC, CHS, CFP, CLU, Advanced Case Consultant | Corporate Asset Efficiency – Putting the pieces together |

| Sep 29 | Tim Lau, CFP, CLU, TOT | Inter-Generation Tax Saving ITSP

Biggest CII Objection: Is it Worthwhile to Apply if There is No Illness Diagnosed |

| Oct 6 | Patricia Carlos, BA, CHS,

Advanced Planning Strategist, Living Benefits |

Solution Selling: Strategies to Protect the Business Owner |

Carriers’ Updates

Canada Life

Good news! SimpleProtect is now available for child policies!

With immediate effect, your clients can apply PAR or CI policies for juvenile between 0 and 17 via SimpleProtect dashboard.

- Juvenile, age 0 to 17 PAR plans from $100K to $250K face amount

- Juvenile, age 0 to 17 Child LifeAdvance from $10K to $25K face amount

Some key highlights of juvenile policy e-application:

- Only one eligibility question for PAR, and two eligibility questions for CI

- Has the insured resided in Canada for the past 12 months, and is either a Canadian citizen or Permanent Resident? (PAR and CI)

- Do you understand spoken and written English? (CI)

- For age 0 to 15, an adult must be the policy owner and signed on the e-application. A parent or guardian will also have to sign the application on behalf of the insured child even though they’re not the owner

- When you are completing the healthcare provider session, “Provider name” and “Date of last visit” are mandatory fields

Review the attached SimpleProtect overview and non-face-to-face reference guide for more details.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions SimpleProtect.

iA

Investment

iA Virtual Summer Tour

For those who missed the final webinar on August 13th, watch the video recording here to review the excerpt from the conversation between Clément Gignac and John Parisella, Senior Advisor, Business Outreach, National.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Business Management on Better Quotation – Save premium, More Businesses — Stephen Lai

11am, Wednesday, August 19th

Come learn how efficient business operations can enhance your business volume and compensation.

3rd Capital Markets Strategy — ML Stefan Goddard

11am, Friday, August 21st

Learn from Stefan on how to immediately close new business and share insights from the capital markets strategies.

Click on the link below to join:

https://manulife-johnhancock.zoom.us/j/2025726491

Events Schedule – September

The Events Schedule for September is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.