The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Canada Life Term Promotion Campaign – Free Premiums Offer Starts Tomorrow!

Canada Life is making a special introductory offer of free three months premium on qualifying, new term 20, term 30 and term-to-age-65 policies, including riders for business in BC. Business from other provinces will enjoy four months premium free.

For a new policy to qualify, the client’s application for the policy must be received between September 1st and December 1st inclusive. This offer extends to reissues, if the original policy qualified. The first premium must be paid for by the client for the contract to take effect.

Review the attached CL Term FAQ Final EN for more details.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 if you have any questions.

Also, join the webinar below to brush-up your usage of SimpleProtect which now allows for juvenile applications.

Webinar: SimpleProtect demos

Time & Date: 10 am, Thursday, September 10th

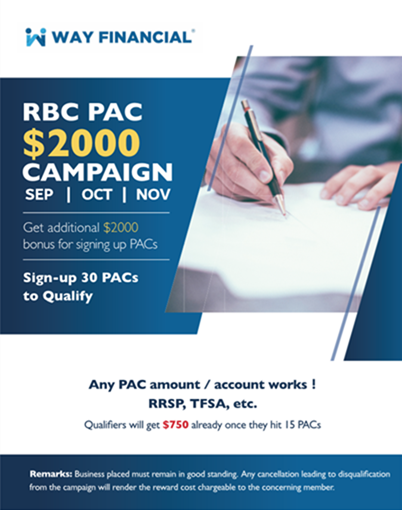

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

The 2nd Series of the RBC PAC $2,000 Campaign will start tomorrow!

Sign up 30 RBC PACs from September to November 2020 to receive an additional $2,000 bonus. Any PAC amount works! And it’s per account, be it RRSP, TFSA, non-reg, etc. Those who sign up 15 plus but less than 30 RBC PACs will also be rewarded with a lump-sum $750 bonus.

To help you quickly grasp the benefits of this concept, and how to close cases and be eligible for the bonus, attendance to the RBC trainings sessions during campaign period is mandatory. The first training session is from 10 to 11am on September 9th. An advance reward will also be announced then so don’t miss out!

Attached are some text templates for your use to get referrals and new business.

Carriers’ Updates

Equitable Life

Equitable Life has announced repricing on Equimax Estate Builder effective September 12th. Click the links below for more information:

Monica Zhang will be going over the details at the webinar this Friday, September 4th, at 11am.

iA

Insurance

iA has finalized the immigrant guidelines on coverage and restrictions to permanent residents and other temporary residents. See the attached PDF iA 30-211A Immigrant Guidelines for more information.

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for any questions you may have.

Investment

On October 26th and November 20th, iA will make changes to its segregated fund line-up. The iA Toolbox is attached for your reference. Also click the link here to find out how to draw up your list of affected clients: https://f.hubspotusercontent10.net/hubfs/4733265/instant-iA/en/GDC%20-%20NOVEMBER%2020%202020.pdf

Attend the presentation on Friday, October 30th, 11am, to find out more.

Meanwhile, contact Hilda Ng at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 for any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Top Members’ Training: Have a Crazy Idea, Have a Dream — Sunny Chan

11am, Wednesday, September 2nd

The spots for in-person participation for this session are open for registration – send an e-mail to admin@wayfinancial.ca to confirm your spot.

Join this session to see what strategies other members use to be successful in their field. Eg. partnership networks, client’s referrals, professional & HNW clients, etc.

Repricing Equimax Par — EQ Monica Zhang

11am, Friday, September 4th

Monica will tell you about the repricing and relevant changes.

Click on the link below to join:

News from the Insurance Council of British Columbia

A Closer Look at the New Practice Audit Program

Launching mid-September, the Practice Audit Program aims to enhance licensee support and public protection.

Audits will be selected based on areas of risk identified annually, as well as on a random basis. The audit process will involve an audit questionnaire form being sent to the licensee. You will have 21 days to complete and return the questionnaire for review by the ICBC’s Practice and Quality Assurance Team. Areas that the audit will look at include: errors and omissions insurance, authority to represent, proper recording of insurance transactions and related financial affairs, client confidentiality practices and compliance with practice advisories.

After the questionnaire is reviewed, if no issues are found, a confirmation letter will be sent and the practice audit is closed. If an issue is identified, the licensee will be contacted by phone to discuss further and may receive a practice reminder letter at which time the audit will be closed. In cases where a serious conduct or competence issue is identified, the matter will be reviewed further.

More detailed information about the Practice Audit Program will be made available on ICBC’s website shortly.

Related Industry News

BC Securities Commission recently issued a significant number of sanctions against Paul Se Hui Oei for misappropriating client funds, including trading ban, registration ban as well as an order to pay $3,087,977.41 and an administrative penalty of $4.5 million. Details are found here: https://www.securities-administrators.ca/disciplinedpersons.aspx?id=74&p=10273

The disciplinary action is a clear indication of zero tolerance for incompliant behaviour from advisors and intends to assist the public and the securities industry in applying due diligence.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.