The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Carriers’ Updates

Canada Life

Repricing of Disability Income and Universal Life plans effective October 13th:

Review the major changes in attached PDF CL DI & UL.

Make use of this last week to get the current rate for your clients!

A new illustration (version 4.4) will be available on October 13th, which includes product updates, pricing changes and software improvements.

New online CE-accredited courses now available:

- Understanding critical illness insurance

- Understanding term life insurance

- Understanding universal life insurance

Note: You can expect to receive your CE certificates by email within 7-10 days of successful course completion.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions you may have.

Equitable Life

Equitable Life is extending the Evidence of Insurability Requirements Temporary schedule until October 31st. See the attached temporary schedule and FAQ for your reference.

Contact Monica Zhang at mzhang@equitable.ca or (604)366-4314 for more details.

iA

Check out the new EVO version 2.4, effective October 5th and download it from here.

Remember the iA dividend bonus for clients will end on October 31st .

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for iA’s new Par and other life business, and Jackie Singzon at (604)220-7692 and Danielle Fairbank danielle.fairbank@ia.ca or (778)886-8492 for Critical Illness and Acci7 Hospitalization Benefit.

Manulife

Further to members’ request on past Friday’s training video, watch the recording here: How Business is Different with COVID-19 Changes in Asian Markets.

Here is a Mandarin third training recording on Manulife’s e-process and underwriting changes presented by Chris Chang for your reference: AMU01 – E-Processes and Underwriting Updates.

Chris can be reached at chris_chang@manulife.com or (604)355-4879 for more details.

Sunlife

Have you checked out the advisor’s best practices on Sunlife’s COVID-19 advisor resource hub? Click here to discover how the resource hub for client-focused advisors can help you from business building to marketing yourself, and client engagement to professional insights.

Contact Viola Lam at Viola.Lam@sunlife.com or (604)417-0791 or Renee Ho at renee.ho@sunlife.com or (604)657-9251 for any questions you may have.

Live webinar: Beyond Illustrations

Time & Date: 10am PST, Wednesday, October 21st

Join the webinar to understand the proper use of life insurance illustrations, comprehend how a dividend scale interest rate (DSIR) for Par insurance is constructed, and what factors are highly correlated to the DSIR.

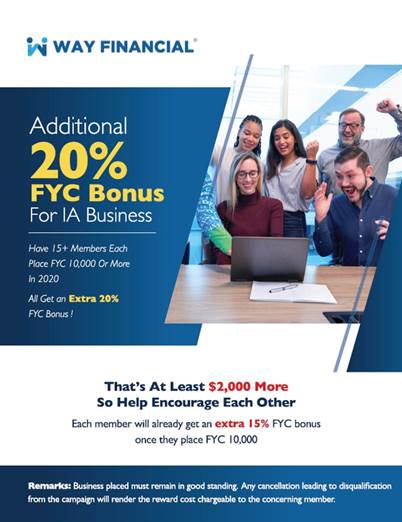

Additional 20% FYC Bonus Campaign for IA Business

Earn Extra 5% FYC Bonus on Your Business

Get additional 5% FYC bonus on your insurance business whenever you connect a new member!

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Advocis Practice Development Module 2A — Marketing

8:30am, Tuesday, October 6th

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

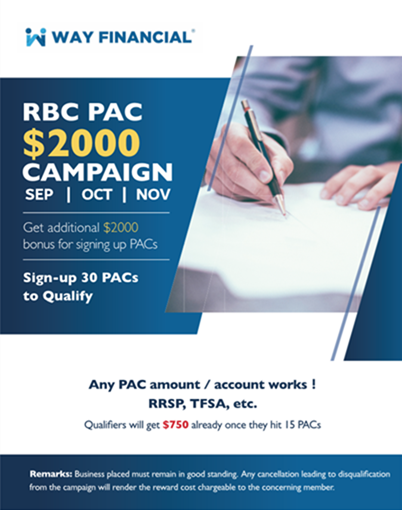

Lump Sum vs PAC: How to Compare — RBC Mike Jackson

10am, Wednesday, October 7th

Get your advance of $100 bonus by submitting 5 PACs and $200 bonus by submitting 10 PACs before this training session!

Top Members’ Training: Always Think Big — Sunny Chan

11am, Wednesday, October 7th

The spots for in-person participation for this session are open for registration – send an e-mail to admin@wayfinancial.ca to confirm your spot.

Permanent Life Insurance Options: A Deeper Dive into Participating Whole Life and Universal Life Insurance — CL Carol Ng

11am, Friday, October 9th

Join Carol’s presentation on permanent life insurance options to reach your business goals.

Holiday Notice

Please note that our office will be closed on:

Monday, October 12th, 2020 (Thanksgiving)

Wednesday, November 11th, 2020 (Remembrance Day)

Normal operations will resume on:

Tuesday, October 13th, 2020

Thursday, November 12th, 2020

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.