The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Reminder on Office Guidelines in Managing COVID-19

A friendly reminder to all members to continue observing the health guidelines on COVID-19 and to keep safe amidst the second wave of the pandemic.

We continue to practice physical distancing and maintain a mandatory mask wearing policy at the office, with visitors sanitizing their hands upon arrival. Fogging/commercial sanitization of the office will be arranged and advance notice will be given to the office users.

Persons who are not feeling well, travelled outside Canada within the last 14 days, who have been in contact with a person confirmed to have COVID-19 or have the following symptoms are asked not to visit:

- Fever

- Chills

- Cough

- Shortness of breath

- Loss of sense of smell or taste

- Diarrhea

- Nausea and vomiting

For contact tracing purpose, please inform the Administration Department at admin@wayfinancial.ca if you have been exposed or diagnosed with the virus.

Our Operations Team continues to be at your service:

-

- process@wayfinancial.ca (for business related matters)

- account@wayfinancial.ca (for compensation related matters)

- admin@wayfinancial.ca (for licensing, E&O and other matters)

Compliance Reminder

Is your Business Compliant?

As an advisor, you’re obligated to operate a compliant practice and meet your regulatory and industry requirements such as Advisor Disclosure, Privacy Consent and suitability documentation. To demonstrate compliance with these requirements your client file must contain:

- A completed advisor disclosure and a privacy consent document, or the combined advisor disclosure and privacy consent which allows you to meet both obligations with one signature.

- Sufficient documentation to demonstrate suitability of the product recommended and sold to the client and how it meets their needs.

- A completed Reason Why Letter or similar documentation is required for both Insurance and Segregated Fund policies.

Additionally, advisors have regulatory obligations to keep:

- Current and complete AML and Privacy compliance programs. Programs need to be updated at least every two years, or when triggered by factors such as changes in legislation, services or products.

Contact Stephen at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114 if you have any questions.

Connection Campaign – Advanced Bonus (October to November)

Many members are already making appointments to introduce their connections to the platform.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

Only five more weeks left to get your $2,000 for the PAC Campaign. Attend RBC Mike’s training next week (10am, Wednesday, November 4th) to learn how to generate Big Results from Small Amounts!

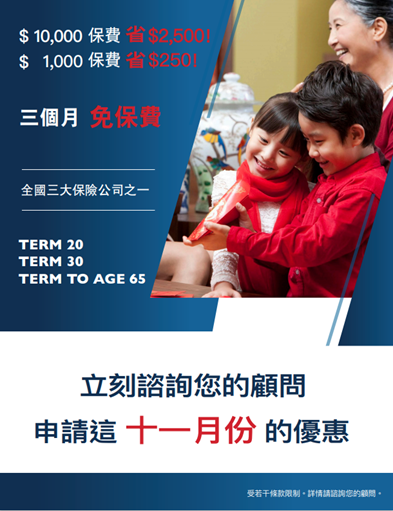

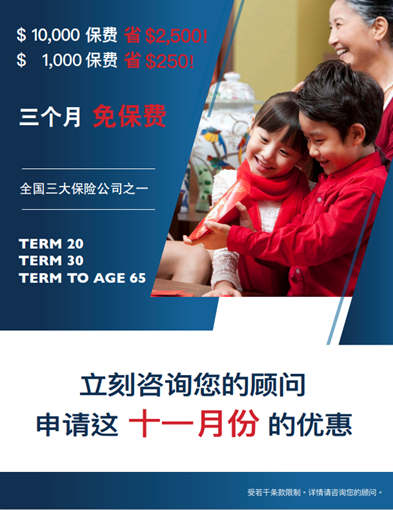

Marketing Poster for Canada Life 3-Months Free Premium Promotion (November)

As previously mentioned, the Platform has designed a poster for your use in promoting the Canada Life 3-Months Free Premium campaign. The poster is designed for members’ unique use so you would not see any logos, including Way’s, on it – feel free to add your own company logo to it. The wording is also intended to push for immediate action from clients. All business must be received between September 1st and December 1st inclusive. This offer extends to reissues, if the original policy qualified. The first premium must be paid for by the client for the contract to take effect.

PDF CL Term FAQ Final EN is attached for your reference.

Check out and utilize the attached and below posters for November:

Carriers’ Updates

Canada Life

Insurance

To make sure any document you submit with an eSignature is accepted the first time, review the attached CL E-signature Checklist and Q&A.

Why do I need to use an eSignature provider?

- Signature validation

- How do I make sure the signature is valid and long-term validation is enabled?

- What can and can’t I do?

Obtaining client verification through non-face-to-face means is now a permanent process for all insurance products.

- The new relaxed underwriting rules for disability insurance are now permanent.

- Some of the higher limits for underwriting critical illness insurance without vitals or fluids are permanent too:

- Ages 18 to 40 for $250,000 or less of coverage

- Ages 41 to 50 for $100,000 or less of coverage

Review the attached CL NF2F Process Chart and CL Insurance Complete Guide for more information.

Contact wholesaler, Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or internal wholesaler, Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 if you have any questions.

Investment

Canada Life new wealth solution – Risk Managed Portfolios designed to help your clients is coming soon. New Risk-Managed Portfolios will be available for sale once the prospectus is approved by industry regulators on or around November 4th.

Check out the resources page to get ready and see what’s new.

Meanwhile, ask Richard Chen at richard.chen@canadalife.com or ((604)338-6416 or internal wholesaler Jessica Leung at jessica.leung@canadalife.com or (604)335-3513 if you have any questions.

iA

iA has informed us that they are making system updates to your Advisor Centre’s login so you temporarily may not able to see your clients’ account. We’re currently following up with iA to get this back on as soon as possible.

Contact the Processing Team at process@wayfinancial.ca if you have any questions.

Investment

iAIM Weekly Fall Series

Webinar #3: Bond market: where to go for safety?

Time & Date: 8am to 8:30am, Wednesday, October 28th

Guest: Alexandre Morin, CFA, Principal Portfolio Manager, Fixed Income

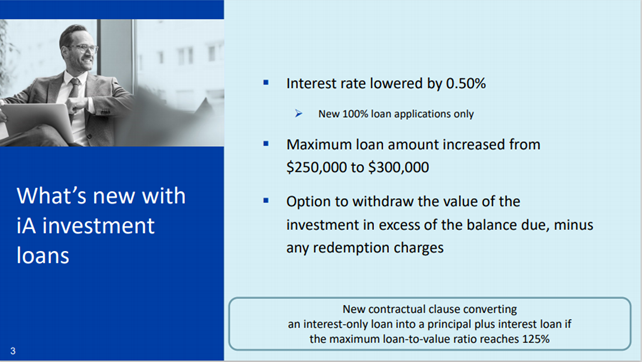

iA revamped investment loan program is here!

More information will be available at Hilda’s training at 11am, this Friday.

Meanwhile, contact Hilda at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Canada Life Days – Registration is open

9:30am, Wednesday, October 28th

Join the sessions which include:

- Insurance sales generators

- Partnering with our advanced team to increase your large case business

- Managed solutions – A look at how they can benefit you, your practice and your clients

Prospecting Strategies: Turn Potential Prospects to Clients — Amanda Ngan

11am, Thursday, October 29th

MDRT prospecting expert, Amanda, will tell you how to generate steady client streams.

iA’s New Investment Funds and Investment Loan Program to Help You Do More Business — iA Hilda Ng

11am, Friday, October 30th

Don’t miss Hilda’s presentation on iA new funds and loan program.

Click on the link below to join:

https://us02web.zoom.us/j/84379499453?pwd=Ym0wZS81UERhRGQwdjZROEV2eEl2dz09

News from the Insurance Council of British Columbia

Disciplinary Decisions

Wah Shing Jacky Chan was disciplined for failing to meet the requirements of the Insurance Council’s continuing education program for three licensing years.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.