The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Client Events for Way Members

Way coordinates for client events that can be utilized by members to help you generate repeated and referral business, build your own reputation in your network, as well as stay connected with your clients. Don’t miss the upcoming sessions in November on high-in-demand topics:

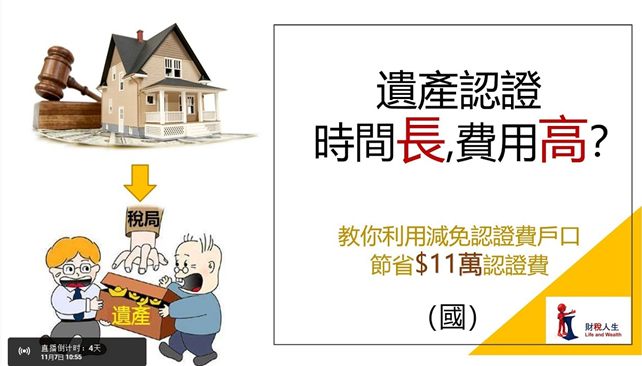

12 Executor Tactics: #3 “Deprobate” Liquid Asset and #12 Long Term Care ROP

Special guest, RBC Mike Jackson, will be interviewed to talk about using segregated funds for estate planning purpose – this is a must-view session for a wide range of clients: those looking at wealth transfer and those who are helping their parents do estate planning.

Time & Date: 10:55 am, Saturday, November 7th

Language: Mandarin

Time & Date: 1:55 pm, Saturday, November 7th

Language: Cantonese

12 Executor Tactics: #7 Participating Cash Value and #10 Back to Back Charity

Time & Date: 10:55 am, Thursday, November 19th

Language: Mandarin

Time & Date: 1:55 pm, Thursday, November 19th

Language: Cantonese

Members who want to invite their clients can register with admin@wayfinancial.ca by indicating the session they are interested in and the names of their guests (don’t forget your own name!). Ask Administration if you have questions on Client Events for Way Members.

Connection Campaign – Advanced Bonus (October to November)

Last month to go to get your advanced bonus for your connections! Don’t wait, set-up your appointments now.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

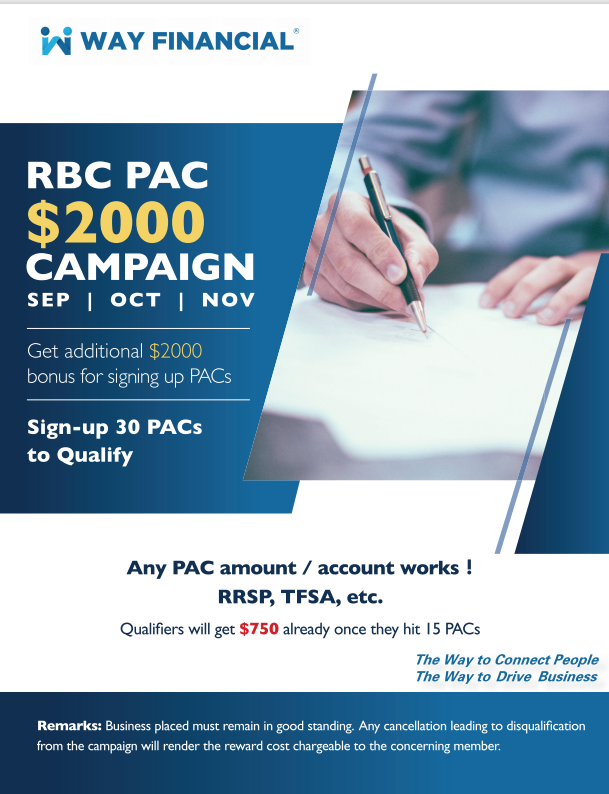

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

Only four more weeks left to get your $2,000 for the PAC Campaign. Attend RBC Mike’s training at 10am, this Wednesday to learn how to generate Big Results from Small Amounts!

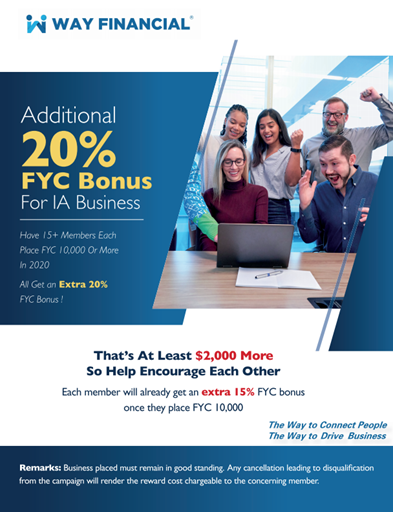

Additional 20% FYC Bonus Campaign for IA Business

Good job to the members who are now on track to getting the CPB this year: Anna Chen, Carmen Ke, Charles Ching, Darren Ng, Ella Chen, Esther Yu, Jack Lai, Jennifer Chan, Kenny So, Paddy Cheung, Patrick Ng, Peter Yeh, Shirley Lu, Sophia Fan, Sophia Li, Stanley Tsui, Wilson Ng and Yuki Ozawa, these members have about 2 more months to place a year total of FYC10,000 to get an additional 15% FYC bonus.

Remember all winners will get a further 5% making the total additional bonus to 20% if there are 15 or more qualifiers!

And for whose who’ve already qualified, doing more business means more total bonus for you.

Connection Campaign 2020 – Earn Extra 5% FYC Bonus on Your Business with Every New Connection

Some members have indicated that business with clients has been slower this year due to the pandemic but don’t let the situation prevent you from growing your overall income. Connect with your external broker network and share with them the different resources you have from the Platform – marketing support, client events, unique trainings, exclusive campaigns, knowledgeable processing, etc., that they are currently lacking and get additional rewards for your connections!

Carriers’ Updates

B2B

B2B has extended its COVID-19 measures for loan applications below:

Until January 31st, 2021, B2B will allow:

- Handwritten signatures on applications and documents scanned and submitted by email

- Digital signatures on applications and documents submitted by email

Please include the EASE number in the subject line and only one client’s application and/or supporting documents per email.

Contact Danya Wang at danya.wang@b2bbank.com or (236)688-6201 for more details.

Canada Life

Insurance

Check out the financial tools here: https://planningtools.ca/ to help plan and meet your clients’ needs.

Contact wholesaler, Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or sales support, Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 if you have any questions.

Investment

Review Canada Life’s new wealth solutions and updates to target risk asset allocation funds on attached CL Risk-Managed Marketing Toolkit and CL Target Risk Asset Allocation Funds Toolkit.

Ask Richard Chen for more information at his webinar at 11am, Friday, November 27th.

Meanwhile, contact Richard Chen at richard.chen@canadalife.com or 604)338-6416 or internal wholesaler Jessica Leung at jessica.leung@canadalife.com or (604)335-3513 if you have any questions.

iA

Investment

iAIM Weekly Fall Series

Webinar #4: U.S. Presidential Elections: Reactions and what’s next?

Time & Date: 9am PST, Wednesday, November 4th

Guest: John Parisella, Senior Advisor, National Expert on American Politics

The presentation file for Hilda’s training last week is attached for your reference.

Contact Hilda at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Small Amount, Big Result — RBC Mike Jackson

10am, Wednesday, November 4th

This is the last training from Mike during this campaign to help you qualify for the bonus.

LTC in View of COVID — SL Renee Ho

11am, Wednesday, November 4th

Listen to Renee’s presentation on changes to LTC coverage and how to promote LTC in view of COVID.

| https://sunlife.zoom.us/my/reneeho |

| Meeting ID: 123 200 4996 |

Preferred Solutions For Individuals — EQ Monica Zhang

11am, Friday, November 6th

Monica will share two case studies to explain using Par WL to offer client much better estate transfer value and retirement income than other investment tools. Sales concept illustrations is included.

Holiday Notice

Please note that our office will be closed on:

Wednesday, November 11th, 2020 (Remembrance Day)

Thursday, December 24th, 2020 (Christmas Eve, closes at 1:30pm)

Friday, December 25th, 2020 (Christmas)

Saturday, December 26th, 2020 (Boxing Day)

Thursday, December 31st, 2020 (New Year’s Eve, closes at 1:30pm)

Friday, January 1st, 2021 (New Year’s Day)

Normal operations will resume on:

Thursday, November 12th, 2020

Monday, December 28th, 2020

Monday, January 4th, 2021

Events Schedule – November (Updated)

The updated Events Schedule for November is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.