The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Connection Campaign – Advanced Bonus (October to November)

For those who have already qualified, reach out to Accounting Department at account@wayfinancial.ca to get your rewards.

For others, there are only two more weeks to get your advanced bonus for your connections! Don’t wait, set-up your appointments now.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/.

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

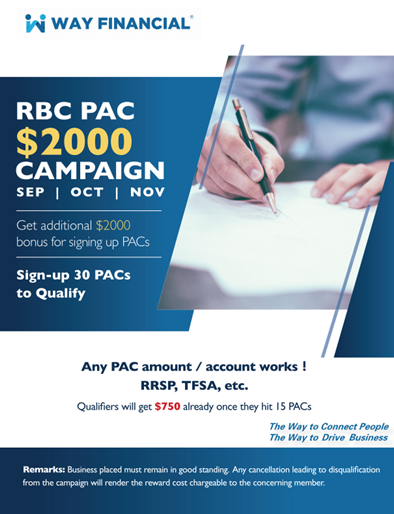

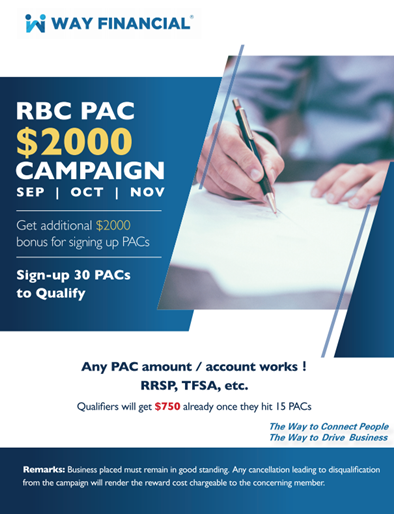

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020) – only two more weeks left!

Visualizing a PAC/DCA Strategy (feel free to share this with your client)

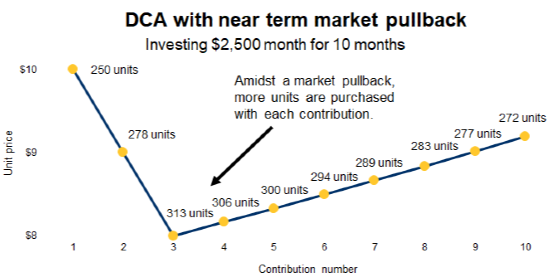

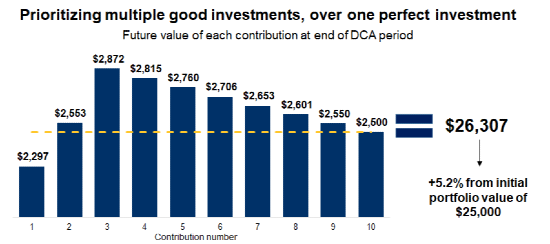

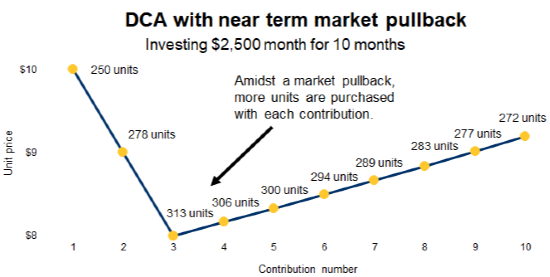

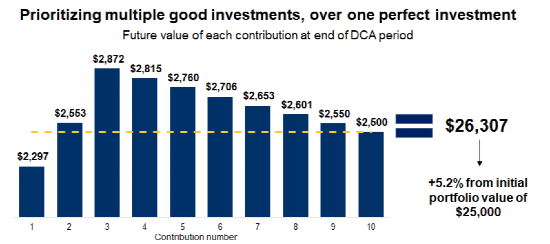

Let’s take a look at an example of a DCA strategy in action. Here we’ll make the following assumptions about the client:

· They have $25,000 in cash to invest.

· The client elects to deploy this cash across ten equal monthly installments of $2,500.

To align this example with the market scenario that many investors fear – a sharp near-term pullback – we’ll make the following assumptions spanning the 10 month DCA period:

· Initial market decline of 20%. Depicted by the unit price of the hypothetical fund falling from $10 to $8 over the first two months.

· Gradual recovery after bottoming. Depicted by the unit price rising from $8 to $9.20 over the ensuing period.

Cumulatively, in this example, the hypothetical fund declines 8% over the ten month DCA period.

Important takeaways for the DCA investor

Despite the uneasy feelings generated from a market pullback, the DCA investor benefits as their $2,500 monthly contributions end up going further – purchasing more units of the fund.

Carriers’ Updates

Canada Life

Investment

The National Bank printed packages which include the borrowing-to-Invest information (46-10482) form is now available electronically only. This form must be submitted with the loan application and investment instructions. PDF CL Borrowing-to-Invest information is attached for your information. Start using the electronic packages tDear Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Connection Campaign – Advanced Bonus (October to November)

For those who have already qualified, reach out to Accounting Department at account@wayfinancial.ca to get your rewards.

For others, there are only two more weeks to get your advanced bonus for your connections! Don’t wait, set-up your appointments now.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/.

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020) – only two more weeks left!

Visualizing a PAC/DCA Strategy (feel free to share this with your client)

Let’s take a look at an example of a DCA strategy in action. Here we’ll make the following assumptions about the client:

· They have $25,000 in cash to invest.

· The client elects to deploy this cash across ten equal monthly installments of $2,500.

To align this example with the market scenario that many investors fear – a sharp near-term pullback – we’ll make the following assumptions spanning the 10 month DCA period:

· Initial market decline of 20%. Depicted by the unit price of the hypothetical fund falling from $10 to $8 over the first two months.

· Gradual recovery after bottoming. Depicted by the unit price rising from $8 to $9.20 over the ensuing period.

Cumulatively, in this example, the hypothetical fund declines 8% over the ten month DCA period.

Important takeaways for the DCA investor

Despite the uneasy feelings generated from a market pullback, the DCA investor benefits as their $2,500 monthly contributions end up going further – purchasing more units of the fund.

Carriers’ Updates

Canada Life

Investment

The National Bank printed packages which include the borrowing-to-Invest information (46-10482) form is now available electronically only. This form must be submitted with the loan application and investment instructions. PDF CL Borrowing-to-Invest information is attached for your information. Start using the electronic packages today!

Join Richard’s training at 11am, Friday, November 27th, to find out more or reach out directly at richard.chen@canadalife.com or (604)338-6416 if you have any questions.

iA

Insurance

See the highlights of transition critical illness insurance below:

|

|

|

|

|

|

|

PDF iA Transition 10-year Payment is attached for your reference.

Contact Jackie Singzon at (604)220-7692 and Danielle Fairbank danielle.fairbank@ia.ca or (778)886-8492 for if you have any questions.

Investment

iAIM Weekly Fall Series

Webinar #6: Corporate credit: Looking towards 2021

Time & Date: 8am to 8:30am, Wednesday, November 18th

Guest: Jean-Pierre D’Agnillo, CFA, Principal Portfolio Manager, Corporate Bonds (iAIM)

Contact Hilda Ng at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

iA Connected – More Social Media Tips

Did you know that Instagram is already being used by approximately 70% of American businesses, and more and more professionals use this network, which has over one billion users, a majority of which are young people and women?

Click here to learn more information.

RBC

Investment

RBC Insurance Wealth Event – Supporting you through times of market uncertainty

Time & Date: 11:30am to 12:30pm, Wednesday, November 25th

Speaker: Norman So, Vice President & Portfolio Manager, Bill Tilford, Vice President & Portfolio Manager & Mike Jackson, Senior Sales Consultant

Registration link: https://vote.pollstream.com/l/Lx24cBI?popup_layout=800

Contact Mike Jackson at mike.jackson@rbc.com or (604)363-7583 or Matthew To at matthew.to@rbc.com or (604)219-0134 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Advocis Practice Development Module — Prospecting

8:30am, Tuesday, November 17th

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

See attached Advocis Module 3 Activity Sheet to refer to during the training.

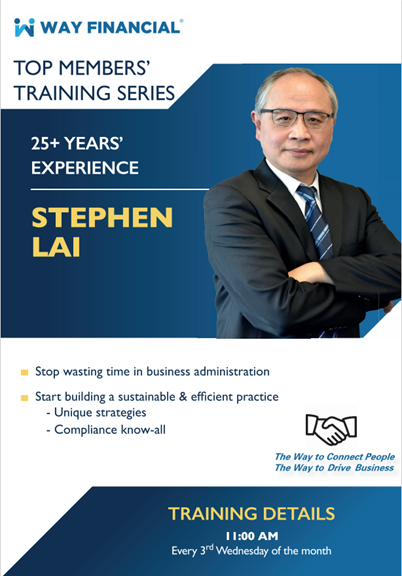

Business Management on Profit Sharing – How Good is It? — Stephen Lai

11am, Wednesday, November 18th

Come learn how efficient business operations can enhance your business volume and compensation.

Hidden Gems with Manulife – How Manulife products Stand Out in Highly Competitive Markets — ML Chris Chang

11am, Friday, November 20th

Listen to Chris’ presentation on how ML products stand out in highly competitive markets.

Events Schedule – December

The Events Schedule for December is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.