The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Reminder on Office Guidelines in Managing COVID-19

This is a friendly reminder to members on following the latest announcements by health officials on the COVID-19 pandemic as well as our office guidelines to ensure a safe and healthy work environment. As the office has announced at the onset, masks are mandatory when coming into the office; they have now become mandatory in all indoor public spaces, so that includes the office building.

The office continues to support members via the telephone, instant messengers and e-mails and arranges for staff to work remotely where possible.

-

- process@wayfinancial.ca (for business related matters)

- account@wayfinancial.ca (for compensation related matters)

- admin@wayfinancial.ca (for licensing, E&O and other matters)

Visitors should sanitize their hands upon arrival at the office. Persons who are not feeling well, have travelled outside Canada within the last 14 days, have been in contact with a person confirmed to have COVID-19 or have the following symptoms are asked not to come to the office:

- Fever

- Chills

- Cough

- Shortness of breath

- Loss of sense of smell or taste

- Diarrhea

- Nausea and vomiting

Let’s all do our part to stop the spread of COVID-19.

Client Events for Way Members – How to Use it in the Most Efficient and Effective Way

Members who have made use of the client events have all received positive feedback from their clients. Now, there is an easier for you to promote this service to your network so as to generate new business and referrals and build your reputation.

For each client event, there will be a registration link along with the related poster for you to send out, broadcast, or simply upload onto your own social media platform. Your clients register by themselves, indicating who invited them, and Administration Department will collect the data for you to follow-up. Before the event, you will be sent the link of the live event and you can either send it to those clients who have registered, or host it as your own client virtual gathering.

Here is the information for the first event in December:

20 Taxman Secret: #1 Principal Home Deduction #18 Intergeneration Tax Saving

Time & Date: 10:55 am, Saturday, December 5th

Language: Mandarin

Time & Date: 1:55 pm, Saturday, December 5th

Language: Cantonese

And here is the registration link: https://forms.gle/GrHd8QEjUZfXHyS67.

Ask admin@wayfinancial.ca if you have any question.

Canada Life Term Promotion Campaign – Free Premiums Offer Extended!

Canada Life is extending their special introductory offer of free three months premium on qualifying, new term 20, term 30 and term-to-age-65 policies, in BC. Business from other provinces will enjoy four months premium free. The last eligible date for application submission is March 1st, 2021.

This is an unprecedented offer and there are also updates on SimpleProtect to make your application process smoother. A client can get $2 million in coverage in just 10 minutes! Watch this video if you do not know how to use SimpleProtect.

The office will be updating the promotional poster for your use with new catch lines, which will be available shortly.

Review the attached CL Term Sales Offer for more details.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any questions.

Getting More New Business and Referrals amidst COVID-19 by Addressing Your Clients’ Concerns

Many clients are concerned about the health and safety of themselves and their loved ones during this second wave of the pandemic.

Refer to the text template on iA Acci7 Plus hospitalization benefits below to help you get new business in midst of the current situation. Note that the FYC rate for Acci7 Plus is 50% of annual premium so it’s definitely an attractive product for both clients and advisors.

Send the following to your clients in two consecutive messages:

- Hi XXX, because I care about your well-being, I am sending you information on insurance that covers for COVID-19 for at least the upcoming few months. Many Canadians should want to apply for it, so please forward the info below to your family and friends.

XXX 你好,在這新冠肺炎肆虐期間,我關心你的健康,請查收若因感染這病毒而要住院的現金保險賠償,你的親友亦會關注,請將以下訊息多轉發。

XXX 您好,在这新冠肺炎肆虐期间,我关心您的健康,请查收若因感染这病毒而要住院的现金保险赔偿,您的亲友亦会关注,请将以下讯息多转发。

- Caring message from advisor, (your first name and last name)

The 2nd wave of COVID is here, it is necessary to know your options of getting cash benefits from coverage on hospitalization due to the virus. See the following hospitalization benefits and consider coverage at a lower rate of $1-2/day for at least these few months. Feel free to call or text xxx (your first and last name and your phone number) to find out more about your rights. Please forward this message and information to people you care about so they can get the same protection.

(你的姓名)的關愛訊息

鑑於COVID的第二次浪潮,萬一不幸染病須要入醫院,你應有權知道如何獲得現金賠償保障。以下是住院保障詳情,每日只須$1-2,欲了解詳情,請致電或短訊給(你的姓名電話號碼XXXXXXXXXX)。請將這訊息轉發給你關心的親友,讓他們獲得基本保障。

(你的姓名)的关爱讯息

鉴于COVID的第二次浪潮,万一不幸染病须要入医院,您应有权知道如何获得现金赔偿保障。 以下是住院保障详情,每日只须$1-2,欲了解详情,请跟我联系(你的姓名电话号码XXXXXXXXXX 或WeChat)。 请将这讯息转发给您关心的亲友,让他们获得基本保障。

”

”

This is not only a convenient way to secure your existing clients, it is also a timely opportunity to prospect and convert those without good service from their existing advisors.

B2B Bank Loan Programs

Year-end is approaching and clients may be making last contributions to their TFSAs and planning for their RRSPs. Explore the option of helping your clients leverage opportunities in getting a TFSA loan or RRSP loan. See the attached overviews and current rates below:

B2B Bank RSP Loan Program Rates

| Amortization Period | Variable Rate Products | Fixed Rate Products |

|---|---|---|

| 1 year | 2.95% (Prime1 + 0.50%) |

5.95% |

| 2 years | 2.95% (Prime1 + 0.50%) |

6.95% |

B2B Bank TFSA Loan Program Rates

| Amortization Period | Variable Rate Products |

|---|---|

| 1 – 2 years | 3.20% (Prime1 + 0.75%) |

More rates information is found here: https://b2bbank.com/advisor-broker-rates/loan-rates

Contact Danya at danya.wang@b2bbank.com or (236)688-6201 if you have any questions.

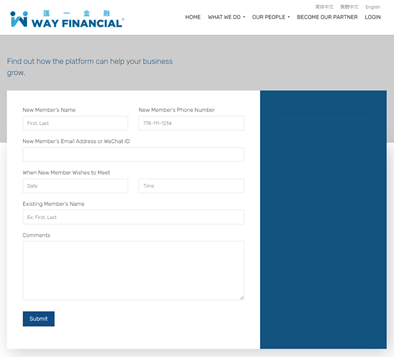

Connection Campaign – Advanced Bonus (October to November)

For those who have already qualified, reach out to Accounting Department at account@wayfinancial.ca to get your rewards.

There is only one more week to get your advanced bonus for your connections! Don’t wait, set-up your appointments now.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/.

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

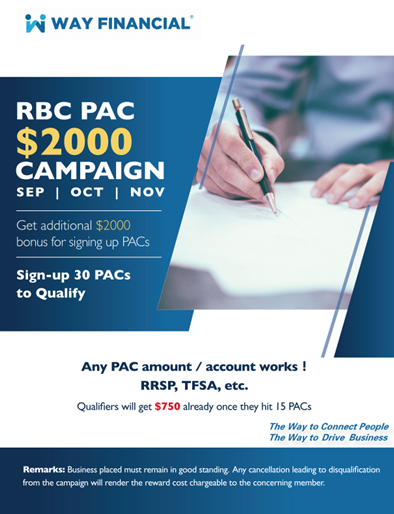

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020) – only one more week left!

Carriers’ Updates

Canada Life

Group Benefits

Use the following one-pager to show your clients what Group Benefits can help them do.

Also attached are the presentation summary on Group Benefits and an quick guideline on Group Retirement Savings Plan.

Contact Jason Yang at YingJason.Yang@canadalife.com or (236)668-3194 if you have any questions.

iA

Investment

We were informed that there was a backlog on paper applications for iA’s RESPs. Use the online application to apply and get account set-up for your clients within 24 hours and to start the PAC within 1 to 3 days! Watch the attached iA RESP Tool Tutorial Video if you do not already know how to use the RESP e-App.

iAIM Weekly Fall Series

Webinar #7: Will 2021 be the year of dividend paying stocks?

Time & Date: 8am to 8:30am, Wednesday, November 25th

Guest: Donny Moss, CFA, Senior Portfolio Manager, North American Equities (iAIM)

For those who missed the iA investment roadshow this show, watch the recording of the presentation here. There will be three more presentations in each of the coming 3 days.

Contact Hilda Ng at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

iA Connected – Transition 10-year Quick-payment Option

Did you know that Canadians have never thought more about their health than in 2020?

Click here to learn how the transition 10-year quick-payment option allows your clients to benefit from lifetime coverage that is fully paid up after 10 years.

Manulife

Insurance

Here’s a recorded video of Chris’s presentation last Friday: Hidden Gems with Manulife – How Manulife products Stand Out in Highly Competitive Markets for your reference.

Contact Chris Chang at chris_chang@manulife.com or (604)355-4879 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Advocis Practice Development Module — Prospecting/Mentor Input

8:30am, Tuesday, November 24th

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

Prospecting Strategies: Prepare Early for the RRSP Season — Amanda Ngan

11am, Wednesday, November 25h

Learn from MDRT prospecting expert, Amanda, will tell you how to generate steady client streams. Amanda will also announce a NEW business campaign to be kick-started next month. Don’t miss out!

Canada Life Wealth Products Update — CL Richard Chen

11am, Friday, November 27th

Richard will give you an update on Canada Life Seg Fund products and review recommended funds with you.

Events Schedule – December (updated)

The updated Events Schedule for December is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.