Happy New Year! May 2021 bring you good health, business and prosperity!

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

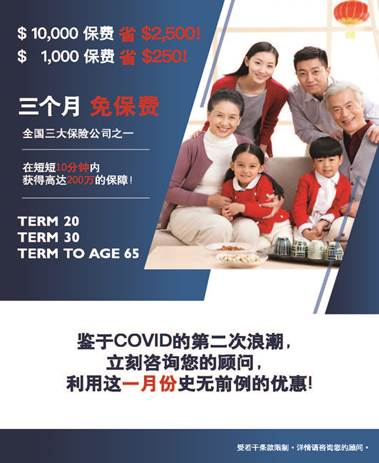

Marketing Poster for Canada Life 3-Months Free Premium Promotion (January)

As previously mentioned, Canada Life is extending their special introductory offer of free three months premium on qualifying, new term 20, term 30 and term-to-age-65 policies, in BC. Business from other provinces will enjoy four months premium free. The last eligible date for application submission is March 1st, 2021. The poster is designed for members’ unique use so you would not see any logos, including Way’s, on it – feel free to add your own company logo to it. The wording is also intended to push for immediate action from clients. There will be a poster for each of the subsequent months of the campaign. This is an unprecedented offer and there are also updates on SimpleProtect to make your application process smoother. A client can get $2 million in coverage in just 10 minutes! Watch this video if you do not know how to use SimpleProtect.

Check out and utilize the attached and below posters for January:

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any questions.

Investment Transfer-in $2,000 Campaign (Dec to Jan)

Only 4 more weeks to go to get an additional $2000 bonus for transferring-in registered investments from third parties (e.g. banks, mutual funds companies,etc.) !

All transfer-in businesses must be funded into a segregated fund account. Any amount qualifies!

Transfer-in 5 clients and qualifiers will already get $500 in advance. 5 different accounts (e.g. 1 RRSP, 1 Spousal RRSP, 1 RRIF, 1 TFSA, 1 RESP) transferred by the same client will also qualify for 5 counts.

Two or more of the same account transferred by the same client will qualify for one count. For example: A mother transfers in 2 RESPs for her different children will be treated as one count.

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.caor 604-279-0866 ext. 114 or Trainer Amanda Ngan (amandangan@aristowealth.ca) for her tips and joint-field-work support in closing these transfer-in business to qualify for the $2,000!

Carriers’ Updates

B2B

Did you know that some of your clients have already gotten a pre-approved RRSP loan from B2B? The clients may have been informed by B2B and it would easy for you to follow-up with them to complete the application. The office has also sent out the client list to relevant members for reference and action.

For other members not yet familiar with the RRSP loan strategy, take a look at the attached PDF and attend upcoming trainings to leverage the business opportunities for the RRSP season!

iA Investment for RRSP Season by Hilda Ng

11am PST, Friday, January 15th

B2B RRSP Loan & RBC Market Update and Funds Recommendation by B2B Danya Wang and RBC Mike Jackson

11am PST, Friday, January 29th

B2B’s RRSP Loan Program features the following:

Deferred payment options

- Flexible terms of 1-10 years

- Multiple funding options

- Easy online application

Wholesaler Danya Wang can be reached at danya.wang@b2bbank.com or (236)688-6201 if you have any questions.

BMO

The new requirement from BMO Insurance on Foreign Account Tax Compliance Act and Common Reporting Standards has become effective on January 1st, 2021. What that means is that BMO now requires to collect a self-certification declaration of tax residency as part of the new application and policy change process for certain life insurance, SPIA and GIF plans.

Contact Greg Einarsson at gregory.einarsson@bmo.com or (236)994-5289 if you have any questions.

Canada Life

In This Week with Canada Life (10am PST on January 6th),President, Quadrus Investment Services Limited and Vice-President, Advisor Compliance and Wealth Distribution, will be joined by Brent Joyce, Vice-President, Investment Strategist, Mackenzie Investments who’ll help set the stage for 2021 with market commentary followed by Richard Bodzy, Portfolio Manager, Putnam Investments and Gregory McCullough, CFA, Portfolio Manager and Analyst, Putnam Investments who manage the US Growth mandate and will share what they forecast in the coming months.

Click here for Registration.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Prospecting Strategies: Real Results of Transferring In by MDRT Amanda Ngan

Learn from MDRT prospecting expert, Amanda, will tell you how to generate steady client streams and qualify for the $2000 Transfer-In Campaign.

11am PST, Wednesday, January 6th

Canada Life Disability Insurance – the Basics and Beyond by Carol Ng

11am PST, Friday, January 8th

Carol will give an introduction of Disability Insurance by pointing some important keys in the basics and beyond. Don’t miss it as it will open up new business opportunities.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.