The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

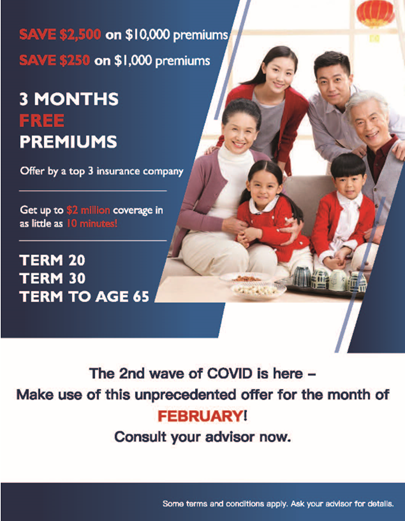

Marketing Poster for Canada Life 3-Months Free Premium Promotion (Februrary)

As previously mentioned, Canada Life is extending their special introductory offer of free three months premium on qualifying, new term 20, term 30 and term-to-age-65 policies, in BC. Business from other provinces will enjoy four months premium free. The last eligible date for application submission is March 1st, 2021. The poster is designed for members’ unique use so you would not see any logos, including Way’s, on it – feel free to add your own company logo to it. The wording is also intended to push for immediate action from clients. There will be a poster for each of the subsequent months of the campaign. This is an unprecedented offer and there are also updates on SimpleProtect to make your application process smoother. A client can get $2 million in coverage in just 10 minutes! Watch this video if you do not know how to use SimpleProtect.

Check out and utilize the attached and below posters for Februrary:

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any questions.

Investment Transfer-in $2,000 Campaign (Dec to Jan)

Last week to go to get an additional $2000 bonus for transferring-in registered investments from third parties (e.g. banks, mutual funds companies,etc.) !

All transfer-in businesses must be funded into a segregated fund account. Any amount qualifies!

Transfer-in 5 clients and qualifiers will already get $500 in advance. 5 different accounts (e.g. 1 RRSP, 1 Spousal RRSP, 1 RRIF, 1 TFSA, 1 RESP) transferred by the same client will also qualify for 5 counts.

Two or more of the same account transferred by the same client will qualify for one count. For example: A mother transfers in 2 RESPs for her different children will be treated as one count.

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114 or Trainer Amanda Ngan (amandangan@aristowealth.ca) for her tips and joint-field-work support in closing these transfer-in business to qualify for the $2,000!

On Using Client Events Effectively and Efficiently – Encore Session

At Stephen’s training last Wednesday on how to use Way Client Events effectively and efficiently, members learned:

- How to create their own client registration form

- The 4 main ways in promoting their own brand, business and reputation using this resource

- Using client events to connect new members

Quite a number of members have requested a follow-up session to set-up their own client registration form for future events and the office will arrange a small group session specifically catered to this need. Please reply to Administration at admin@wayfinancial.ca by Wednesday (January 27) if you are interested in joining as we want to help you create the form in time for next month’s events, starting with the one on Saturday, February 6.

Carriers’ Updates

Canada Life

Repnet now hosts a few CE accredited courses; take a look at the attachment (CL_The continuing Education for CE) from Canada Life for more details.

iA

iA Connect

iA offers some additional marketing tools to make your 2021 RRSP or TFSA business success. Please click here for information on prestige groupings, new preapproved RRSP loans, amongst others.

Manulife

Investment

Manulife Chief Investment Strategist, Philip Petursson, will be hosting his upcoming market update covering the following topics:

10:00am PST, Thursday, January 28

- Market outlook for 2021 which includes expected returns, political landscape, as well as a review of 2020

- Equity and fixed income opportunities and risks

- Update on Philip’s model portfolio and recommended funds

RBC

The updated Financial Facts sheet for 2020-2021 has been completed. Refer to the attached (RBC_Financial Facts Sheet) and have it handy during your meetings or conversations with clients and prospects.

Please feel free to contact Mike Jackson at mike.jackson@rbc.com or (604)363-7583) or Keni Ng rbciwwreq@rbc.com or (604)230-4717.

Sun Life

Sun Life is making a change to the dividend scale by lowering it from 6.25% to 6.00% on April 1, 2021. Check here for more details.

Contact Viola Lam at Viola.Lam@sunlife.com or (604)417-0791 or Renee Ho at renee.ho@sunlife.com or (604)657-9251 for any questions you may have.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Allianz Global – Travel Insurance: Visitor to Canada Plan Update & Rates Change – Judi Kjartansson

Judi will give you an update on Travel Insurance. You will be able to provide a good analysis and recommendation to your clients who need Visitor to Canada Plan.

11am PST, Wednesday, January 27

B2B RRSP Loan & RBC Market Update and Funds Recommendation – B2B Danya Wang and RBC Mike Jackson

Please join the joint session by B2B and RBC. Danya and Mike will show you how RRSP Loan and RBC Funds work together for this RRSP loan strategy.

11am PST, Friday, January 29

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.