The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

RBC PAC $2000 Campaign – Congratulations to the Winners!

After three months of specialized training and turning words into action, we are proud to announce the eight winners who have qualified for the different rewards of the RBC PAC Campaign: $100, $200, $750 and also $2,000!

Congratulations to Jennifer Chan, Margaret Cheung, Ella Law, Paula Law, Wilson Ng, Jackie Pui, Andy Tsai and Dominic Wong!

Accounting Department will be in touch with you on collecting your rewards.

This is only the beginning of a successful way to grow your residual income and clientele. These winners will further receive special training as well as resources on promoting this PAC concept, such as tailor-made marketing materials and virtual client events. Congratulations once again, and let’s reap more benefits from winning this campaign in addition to the initial reward.

Getting More New Business and Referrals by making use of COVID-19

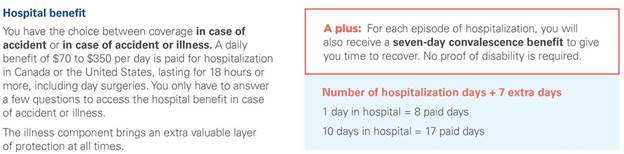

Last week, we sent out a text template on iA Acci7 Plus hospitalization benefits to help you get new business in midst of the current situation. This week, refer to the additional template below on making it easy for your clients to forward to their network to help you generate referrals.

Send the following to your clients in two consecutive messages:

- “Hi XXX, because I care about your well-being, I am sending you information on insurance that still covers COVID-19. Please forward it to your friends, as they are probably not aware of it.”

- “Caring message from advisor, (your first name and last name)

In midst of the current COVID-19 situation, it is necessary to know your options of getting coverage in case of hospitalization due to the virus. See the following hospital benefit and consider coverage at a low rate of $1-2/day for at least these few months. Feel free to give xxx (your first and last name) a call or text at (your phone number) so you can find out more about your rights. Please forward this message and information to people you care about so they can get protection in case of getting the virus.

”

”

A Chinese version will be available shortly. This is not only a convenient way to secure your existing clients, it is also a timely opportunity to prospect and convert those without good service from their existing advisors.

Carriers Updates

Canada Life

Insurance

An update of non-face-to-face processing and underwriting is attached for your reference: CL Insurance COVID-19

Premiums deferral for up to 90 days is available on a case by case basis.

Join the webinar at 10am, this Wednesday, April 8th, to find out more.

Equitable Life

Check out the identification process for non-face-to-face meetings as well as the presentation from last Friday’s training in the attachments to be updated on the latest guidelines: EQ Verification Steps and EQ EZcomplete NF2F

iA

Insurance

iA has also allowed for premiums deferral – see the attached guidelines: IA Premium Deferral

Updates on getting Critical Illness for Immigrant/Temporary Resident Market:

Work Permits (including nannies) – eligible for Life/CI/DI (seasonal workers)

- Max CI amount is $100,000 but a higher CI amount may be available for doctors ($1,000,000) and professional/skilled workers/entrepreneurs who entered Canada under an immigration Canada program ($500,000)

Cancer Guard – as long as the client has been living in Canada for last 12 months can apply for up to $150,000.

Underwriting – Vitals & Blood are waved

- Immigrants for less than 1 years = No more Paramedical/blood/vitals – Phone interview instead

Investment

See the attached presentation from last week’s training on non-face-to-face investment business update: IA EVO Savings Sales Teams

Contact Hilda Ng, Director of Sales, Investments, at hilda.ng@ia.ca or 236-688-6201 or internal wholesaler Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 for more details.

New B2B Wholesaler

New B2B Business Development Manager, Danya Wang, is now on board to help you answer any questions you may have on investment loans and leverage opportunities in view of the current market. You can reach her at danya.wang@b2bbank.com or 236-688-6201.

Upcoming Virtual Trainings

Helping Way Members Continue Business Using Technology & Online Support from Canada Life

Learn CL’s non face to face application through Simple Protect and their relaxed underwriting guidelines.

Click on the link to login at that time.

Real Life Case Studies: RRSP Meltdown – Help Your Clients Tax Efficient Plan their Retirement – COT Carmen Ke

Learn from the best and have COT Carmen Ke help you increase your closing rate and teach you tactics in dealing with different clienteles.

Click on the link to login at that time.

https://us04web.zoom.us/j/277397230

Business Management on Property Tax Deferment: How much do you know? – Stephen Lai

Come learn how efficient business operations can enhance your business volume and compensation.

Click on the link to login at that time.

https://us04web.zoom.us/j/832600072?pwd=SVZPM2pHOHJyVEVVaGdVTHJOM3hLZz09

Annual Filing 2020 Now Open

2020 annual filing for all Insurance Council of BC licensees is now available. Filing will be carried out through the Insurance Council’s Online Portal exclusively this year, in compliance with physical distancing measures directed by the Provincial Health Officer. The deadline to complete your annual filing is June 1, 2020.

The filing fee for this year is $225 (including government fee). After June 1, all filings received will be subject to a late fee ($200) for a total of $425.

Please be aware that any licenses not renewed via annual filing by July 31, 2020, will be terminated automatically for non-filing.

How to File

You can complete your filing online at insurancecouncilofbc.com/annualfiling.

Filing consists of:

- Completing your filing declaration

- Remitting the annual filing fee

See Filing Instructions.

To complete your annual filing, your filing declaration and fee must be received by the Insurance Council no later than June 1, 2020.

New Feature Available: License Certificates

After your annual filing is complete you can download and print your license certificate. In the main menu for the Online Portal, click on “View/Print My License Certificate.”

Send admin@wayfinancial.ca a copy of your renewed license to have it distributed to the relevant carriers to ensure your business processing and compensation payments carry on without interruption. Do not send us the payment receipt as carriers do not accept this as a record of your renewed license.

If you require instructions to help you with the registration and online filing process, please contact ICBC at 604-688-0321. For annual filing help, press 5 or email filingsupport@insurancecouncilofbc.com .