The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Carriers Updates

Canada Life

Group Benefits

Canada Life has announced temporary premium reductions for its group benefits plans: https://s3-us-west-2.amazonaws.com/assets.cl-toolkit.com/DMO/1-Emails/2020/DMO-5514/COVID-19-Premium-Adjustments-Advisor-Groupline-April-17.pdf?cid=eb%7CGroupBenefit%7CCL%20-%20GB%20Advisors%20-%20Premium%20Reduction%20Email%20-%20April%2017,%202020%7CDMO-5513

Here’s a brief summary:

- Dental: 50% premium reduction adjustment will be applied.

- Vision: 20% premium reduction adjustment will be applied.

- Healthcare (excluding drugs): 20% premium reduction adjustment will be applied.

IA

Distance-selling for Non-Registered contracts with more than $100,000 now available in EVO.

Total amount of the one-time contribution may be allocated as follows:

- Amount lower than $1,000,000 in investment funds

- Amount lower than $1,000,000 in Guaranteed Interest Funds

- Amount lower than $2,000,000 combined within the Daily Interest Fund+ and the High Interest Savings Account

Click on https://covid-advisor.ia.ca/non-reg-savings-plans-distance-selling-evo for more details.

RBC

RBC is requiring all deposits to be submitted via One-Time PAD (https://www.rbcinsurance.com/salesresourcecentre/file-848746.pdf) – so no cheque payments allowed. Please see the attached “RBC Covid19 Update” for details.

The attached “RBC Wealthlink Enhancements” gives details on the recently added functions to WealthLink to help you manage business easier amidst COVID-19.

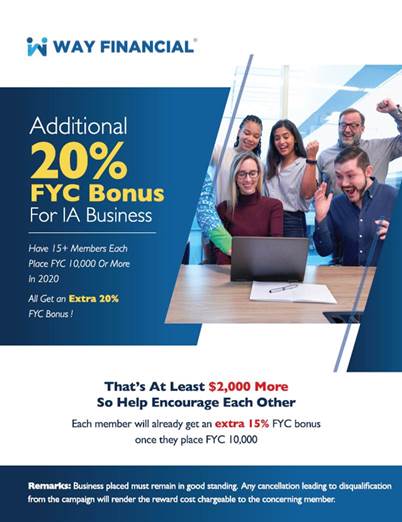

Additional 20% FYC Bonus Campaign for IA Business

In midst of virus fears, a lot of clients has been initiating the request for life and health insurance coverage. Let’s all grasp this opportunity to earn an additional 20% FYC bonus this year! Join the webinar on Apr 29th to learn more.

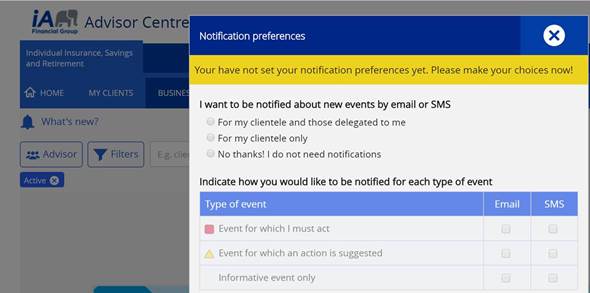

iA Business Tracker: Set-up now to not miss any information notifications on your business

As we have previously mentioned, iA will be launching a Business Tracker to help advisors do business easier. Starting April 26th, iA will directly send advisors notifications relating to new business submission, in-force policies, etc. The Tracker will also let you know about business opportunities such as upcoming policy renewals or missing information for a new business and provide you with the relevant form to complete.

If you haven’t already done so, logon to Advisor Centre now to update your notification preferences so you won’t miss important messages on your business. Sign in at ia.ca and click on the Business Tracker tab in the top to set your preferences.

Upcoming Virtual Trainings

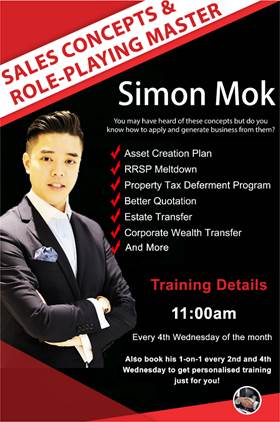

Role Play 3rd Closing and Objection Handling – 3 RRSP mistakes and 9 solutions (#8 Interest Deduction) – Simon Mok

Click on the link below to see what top sales, Simon Mok, has to share with you this month on creating needs for clients and closing the sale.

https://us04web.zoom.us/j/7073259199

Long Term Care Insurance 2nd Series — SL Viola Lam

Find out how to close more business by incorporating LTCI from SL’s presentation.

Register in advance for this webinar:

https://sunlife.zoom.us/webinar/register/WN__gjbp87gRHmhKNVysXdHxw

Notice from the Insurance Council of British Columbia

The coronavirus (COVID-19) outbreak is causing widespread concern and increasing economic hardship for consumers, businesses and communities. During this unprecedented time, be mindful that there shall be no personal financial dealings with clients.

Some examples of personal financial dealings are:

- Paying premiums on behalf of the client

- Loaning money to the client

- Depositing funds into the client’s investment contract

Conflict of interest is defined as any activity or relationship that places the advisor in a position where their professional and personal interests conflict. Please refer to the Council Rules and Council Code of Conduct for further details.

Anyone who breaches the Council Rules and Council Code of Conduct may be subject to possible termination and may be reported to Regulators to determine if further disciplinary action is required.

Advice on the Roles & Duties of Non-Licensed Assistants

Attached is a summary of the roles & duties of non-licensed assistants as deemed appropriate by the different carriers for your reference. Do incorporate it into your business practice to ensure compliance standards are met. Please feel free to reach out to Stephen Lai (stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114) for further advice if necessary.

Events Schedule – May (Updated)

The updated Events Schedule for May is attached for your reference.