The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Virtual Client Events

As previously mentioned, the Platform is supporting different virtual client events that members can utilize in connecting with clients and generating new referrals and business during this time.

These additional resources are provided to qualified members who have shown commitment to their own business development such as this week’s Webinar with Q&A on Market Updates hosted by RBCI exclusively for Way advisors’ clients. See more details below:

RBCI Market Update for Way Advisors’ Clients

Time & Date: 10 am, Thursday, May 7th

Language: English

Speaker: Mike Jackson CFP, CLU, CIM, FMA, FCSI

Qualified members include recent winners of the RBC PAC Campaign as well as those who have done notable RBCI investment business. Ask Administration Department for details on how to participate and share the resource with your clients.

11 Ways of Property Tax Coding

Time & Date: 11 am, Thursday, May 14th

Language: Mandarin

Time & Date: 2 pm, Thursday, May 14th

Language: Cantonese

Speaker: Global Wealth Life

Global Wealth Life hosts a series of webinars for clients including Crisis Rebound Investment Secret Manual, RRSP Mistakes & Solutions amongst others. Contact Theresa Lai at 604-278-0122 (ext. 105) or theresa.lai@grandtag.ca for more details on how to participate and share the resource with your clients.

Tailormade Training Series for Closing Corporate Cases

Some of you may have already received an invitation to participate in the 9-classes training series on doing business with corporate clients. Please see the attached information on the Training Program:

- Scaling Strategies to Generate Corporate Clients 200330

- 9 Classes Scaling Strategies to Generate Corporate Clients – Training Schedule

Most advisors know clients with companies but have struggled to tap into their corporate business potential. This is a special program to help such committed members close cases, win the Additional 20%+ FYC Bonus Campaign with iA AND the Spring Contest (details below), and open up new residual income channels.

Contact Stephen Lai at stephen.lai@wayfinancial.ca or (604) 279-0866 (ext. 114) to see what qualifications you need to sign up for these classes.

Carriers Updates

Canada Life

$2 million of life insurance without paramedicals

- CL will now underwrite up to $2,000,000 of life insurance without vitals or fluids for clients ages 18 to 40 and up to $1 million for ages 41 to 50.

Digital contract delivery from Canada Life is here. Click here for the digital contract delivery training material to learn more.

Equitable Life

Revised guidelines for policy e-delivery:

Step 1 – When policy is approved, it will be emailed to advisor. Advisor will use their Equitable Advisor Code to open the link containing all documents.

Step 2 – Advisor reviews policy and delivery requirements for accuracy.

Step 3 – Advisor electronically signs the package and it gets forwarded automatically to client’s email.

Step 4 – Advisor tells client an email has been sent and the client uses the policy # to open the link.

Step 5 – Client and advisor review package together.

Step 6 – Client uses e-signature to accept. Then both client and advisor can download/save the policy. Advisor e-mails a PDF copy to Processing Team (process@wayfinancial.ca)

Step 7 – File is sent electronically to New Business Department for final action to settle policy.

Step 8 – E-payment

* Client pays annual premium by online-banking. Payee of online banking is “Equitable Life & CI”

* PAD for one-time withdrawal of annual premiums for $20,000 or more only

* EFT or wire transfer on exception basis only

Click here for more detailed instructions: https://advisor.equitable.ca/advisor/en/Individual-Insurance/Instruction-Page

Sunlife

See the attached presentation from last month on non-face-to-face process update: SL Non-Face-to-Face

Additional reference materials highlighting Sun Life Long Term Care and Retirement Health Assist are also attached for your reference: SL LTC Product Feature & SL RHA Product Feature.

To learn more about LTC/RHA or require help on cases, contact Renee Ho at renee.ho@sunlife.com or (604)657-9251 or Viola Lam at viola.Lam@sunlife.com or (604)417-0791.

IA Spring Fling Contest

Let’s win some extra $$$ from iA’s Spring Contest, which is exclusive to Way Members! It runs from May 1st to July 3rd.

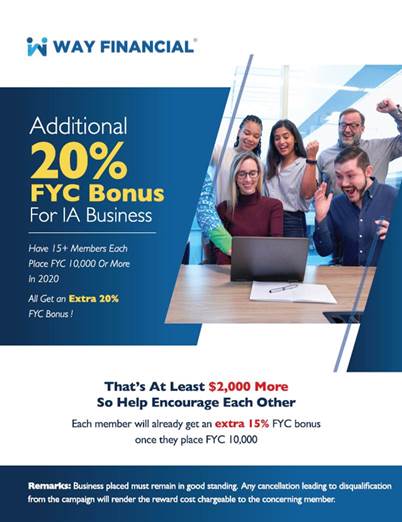

Additional 20% FYC Bonus Campaign for IA Business

The Hospitalization Benefits from Acci7-Plus also counts!

In midst of virus fears, a lot of clients has been initiating the request for life and health insurance coverage. Let’s all grasp this opportunity to earn an additional 20% FYC bonus this year!

Upcoming Virtual Trainings

Market Volatility and the Benefits of Segregated Funds for Different Types of Clients — RBC Mike Jackson

Listen to RBC’s presentation on why segregated funds are the best choice in the current market volatility.

Register in advanced for this webinar:

https://rbcteams.webex.com/rbcteams/onstage/g.php?MTID=e053f9e101cc71b95e6629680dead7435

Canada Life CI and Our Competitive Advantage — CL Patricia Carlos

See CL’s new CI enhancements for high net worth client and how it fits into different market segments.

Insurance Council License Renewal Deadline Soon

The June 1st deadline for renewing your license is fast approaching. Send admin@wayfinancial.ca a copy of your renewed license to have it distributed to the relevant carriers to ensure your business processing and compensation payments carry on without interruption. Do not send us the payment receipt as carriers do not accept this as a record of your renewed license.

The filing fee for this year is $225 (including government fee). After June 1st, all filings received will be subject to a late fee ($200) for a total of $425.

Please be aware that any licenses not renewed via annual filing by July 31st, 2020, will be terminated automatically for non-filing.

How to File

You can complete your filing online at insurancecouncilofbc.com/annualfiling.

Filing consists of:

- Completing your filing declaration

- Remitting the annual filing fee

See Filing Instructions.

Deadline to Complete Continuing Education Extended

The deadline for Insurance Council licensees to complete annual continuing education (CE) requirements for 2020 has been extended to the following year, May 31st, 2021. Licensees will still need to complete annual filing for this year by June 1, 2020 even if you haven’t completed your CE credits yet.

Go to the Council’s website for more information on the extension, including a Q&A.

Holiday Notice

Please note that our office will be closed on:

Monday, May 18th, 2020 (Victoria Day)

Normal operations will resume on: