The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Updates on Office Guidelines in Managing COVID-19

Way continues to be prudent in managing the risk and safe-guarding the health and safety of our members while using innovative ways to help everyone continue and also grow business. It is encouraging to see more activities and submissions from members in the past month and those who have adopted new practices using technology and a creative and willing mindset have gotten positive results.

Some members have requested resuming in-person training sessions to garner more momentum in rebuilding their business. Considering the different factors involved, the office will start arranging a hybrid setting with limited capacity for in-person participation and simultaneously broadcasting to those who prefer learning remotely via online meeting platforms like MS Teams.

The first hybrid session will be arranged for the training at 11am, on August 26th:

Role Play on Close deal of Technology “Precision” Proposal to Transfer RRSP and TFSA from Other Parties. Much easier to provide needs — Simon Mok

As in-person seating will be limited to maintain distancing, please RSVP to Administration Department should you wish to take up a spot. First come first served.

The hybrid setting will also be arranged for other internal training sessions starting September, as well as certain carriers’ training. You will be informed which session allows for in-person participation later on.

In visiting the office, everyone should continue maintaining high level of personal hygiene and be mindful of the following when you enter the premise:

- Sanitize your hands and put on a face mask;

- Keep a good distance when communicating with each other in person; and

- Ask your visitors to do the same above.

Our Processing and Accounting teams remain in full-day service. Send us an e-mail for any enquiry or request you may have:

-

- process@wayfinancial.ca (for business related matters)

- account@wayfinancial.ca (for compensation related matters)

- admin@wayfinancial.ca (for licensing, E&O and other matters)

Let’s return our attention to growing business while continuing our efforts to keep this virus at bay.

MDRT Articles Free Subscription & Video Viewing Sessions

Way is now offering all members a free subscription to MDRT articles to gain insight on enhancing and developing your business. The articles are sent out the beginning of each week and will replace the Food for Thought of the Day. All members will be invited to the mailing list to enjoy the free subscription this month and starting September, the free subscription will continue for members who submitted business in the previous month. Any amount of business submission qualifies.

Every Tuesday morning, from 11am to 12pm, a series of MDRT videos will be played at the Boardroom. The speakers of these videos are all MDRT qualifiers and successful players and you can learn how to be a successful advisor from their valuable experience. There’s no need to RSVP, just come in to the office to view the videos. Alternatively, live broadcasting is available and the link will be marked on your calendars.

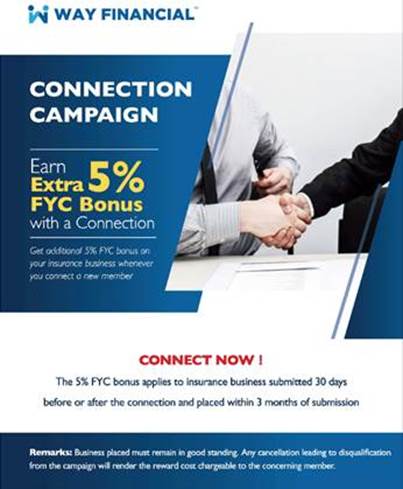

Connection Campaign 2020 – Earn Extra 5% FYC Bonus on Your Business with Every New Connection

While the current situation gives you the opportunity to outshine your competitors and showcase to your clients your continuous support to their financial well-being, it is also the time to connect your external broker network and share with them the different resources you have from the Platform – marketing support, client events, unique trainings, exclusive campaigns, knowledgeable processing, etc., and get additional rewards for your connections!

Carriers’ Updates

Canada Life

Canada Life has reduced the waiting period from 30 days to 14 days for international travel in new applications:

- Anyone who has recently returned from outside of Canada will have their insurance application postponed until they have been back in Canada for a minimum of 14 days. After the period of quarantine, Canada Life would consider reopening the file. Any file postponed would not be eligible for TIA or CIA benefits.

Paramedical services are continuing to operate on reduced capacity and temporary relaxed requirements are remained for the time being.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions on the process.

iA

Investment

iA Virtual Summer Tour

Join Clément Gignac, Senior Vice-President and Chief Economist, on his new series of webinars with weekly special guests every Thursday at 8am which run until August 13th.

Webinar #9: 2020 US presidential election and its impact

Time & Date: 8am to 8:30am, Thursday, August 13th

Guest: John Parisella, Senior Advisor, Business Outreach National

For those who missed the webinar on August 6th, see the attached PDF to review the discussion on investment opportunities in global equities with Pierre Chapdelaine, CFA, Principal Portfolio Manager, International Equities, iAIM.

Sun Life

Paramedical providers are now offering mobile appointments, with the choice of:

- requesting Sun Life to order on your behalf, or

- ordering medical requirements directly through ExamOne or Dynacare based on the age and amount requirements.

This applies to all new applications effective immediately.

- If you have Sun Life order medical requirements on your behalf, please clearly indicate this on the application in the Advisor Report section and Sun Life will continue to apply temporary measures and/or Accelerated Underwriting practices. Click here for more details.

- If you place the order for medical requirements, please provide Sun Life with the order number and vendor name on the application in the Advisor Report section and you will be opting out of temporary measures and Accelerated Underwriting. Check the Dynacare’s website and ExamOne’s website for more details.

Contact Renee Ho at renee.ho@sunlife.com or (604)657-9251 or Viola Lam at viola.Lam@sunlife.com or (604)417-0791 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

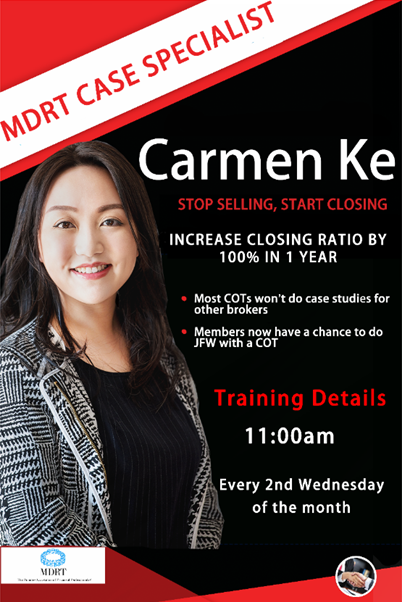

Real Life Case Studies: Tax Advantages on Corporate CI Shared Ownership — COT Carmen Ke

11am, Wednesday, August 12th

Remember that attendees to this training will be provided with the illustration for the concept. Also make use of the attached text templates to start generating interest amongst your corporate client network!

Learn from the best and have MDRT Member, Carmen Ke, help you increase your closing rate and teach you tactics in dealing with different clienteles.

Corporate-owned Life Insurance and Planning Considerations — CL Carol Ng & Leon Chan

11am, Friday, August 14th

CL Carol and Leon will go through some taxation basics and comparing corporate owned insurance vs corporate-owned investments with you.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.