The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Update to Office Guidelines for COVID-19

While we continue to follow measures to safeguard against COVID-19, the office is working closely with members looking to outshine others amidst current challenges.

Front desk service resumes to full day capacity in September, helping you greet your clients throughout the 9:30am to 5:30pm.

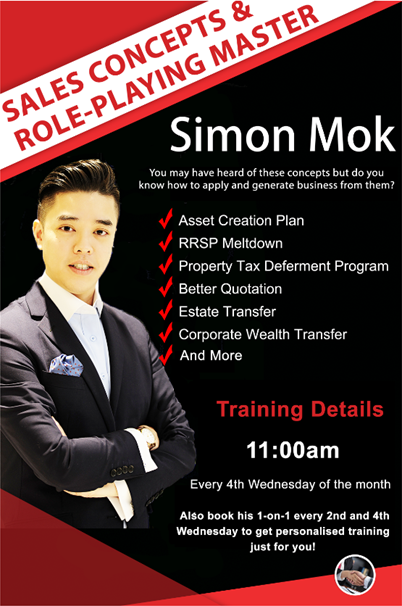

A limited number of in-person training spots will be offered, starting with the session this Wednesday on Role Play on Close deal of Technology “Precision” Proposal to Transfer RRSP and TFSA from Other Parties. Much easier to provide needs by Simon Mok. Please RSVP to Administration Department should you wish to take up a spot. First come first served.

Upcoming training sessions that offer in-person participation are:

Top Members’ Training: Have a Crazy Idea, Have a Dream

Time & Date: 11 am, Wednesday, September 2nd

Speaker: Sunny Chan

Business Management on Plan Your Year-end Tax in Advance

Time & Date: 11 am, Wednesday, September 16th

Speaker: Stephen Lai

Focus Group on Corporate Cases

Time & Date: 10 am, Tuesday, September 15th & September 29th

Speaker: Tim Lau

Market Update & Outlook for the Next of the Year

Time & Date: 11 am, Friday, October 16th

Speaker: Manulife Stefan Goddard

In visiting the office, everyone should continue maintaining high level of personal hygiene and be mindful of the following when you enter the premise:

- Sanitize your hands and put on a face mask;

- Keep a good distance when communicating with each other in person; and

- Ask your visitors to do the same above.

Focus Group on Corporate Cases (September 1 to October 6) – Door Opener Text Templates attached

Members who have applied to participate in the Focus Group on Corporate Cases are building their client networks by generating interest via text messages on the Health Spending Account (HSA). This is an easy and straightforward way to start talking to those clients with companies on your financial planning service for their corporations. Refer to the attached text templates.

Please note the registration is already full and this is the last week for pre-requisites to be completed to secure your spot!

| Date

(Time: 10am to 12pm) |

Speaker | Topic |

| Sep 1 | Leon Chan, CPA, BBA,

Wealth & Tax Planning Consultant Stephanie Carter, RN, BSCN, FALU, FLMI, ACS, ARA, AIRC, ASRI Underwriting Specialist |

Corporate 101 whiteboard session & insurance planning opportunities

Financial Underwriting of Corporate Owned Insurance |

| Sep 8 | Leon Chan, CPA, BBA

Wealth & Tax Planning Consultant |

Fact finding and optimized discussions with high net worth clients |

| Sep 15 | Jeff Nason, BA, EPC, CHS, CFP, CLU, Advanced Case Consultant

Tim Lau, CFP, CLU, TOT |

Bridging the gap: From Fact-Find to Solution-Selling

Inter-Generation Tax Saving ITSP |

| Sep 22 | Jeff Nason, BA, EPC, CHS, CFP, CLU, Advanced Case Consultant | Corporate Asset Efficiency – Putting the pieces together |

| Sep 29 | Tim Lau, CFP, CLU, TOT | Inter-Generation Tax Saving ITSP

Biggest CII Objection: Is it Worthwhile to Apply if There is No Illness Diagnosed |

| Oct 6 | Patricia Carlos, BA, CHS,

Advanced Planning Strategist, Living Benefits |

Solution Selling: Strategies to Protect the Business Owner |

Carriers’ Updates

Canada Life

DocuSign submission process for National Bank investment loans, investment lines of credit and RRSPs are now available to the following:

- Existing clients who have products with Canada Life or National Bank.

- Clients who have an existing relationship with you.

Note that this process does not apply to new clients, unless they’re authenticated and identified in person.

Review the digital process with your existing clients and use the enclosed email template for securely sharing documents.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions on the process.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Role Play on Close deal of Technology “Precision” Proposal to Transfer RRSP and TFSA from Other Parties. Much easier to provide needs — Simon Mok

11am, Wednesday, August 26th

The spots for in-person participation for this session are already full; other members can participate via the link below to watch the presentation online:

Come learn how efficient business operations can enhance your business volume and compensation.

CII & Quickpay 10 Reintroduction — IA Jackie Singzon

11am, Friday, August 28th

Let’s start the conversation with Jackie on CII and updates.

Click on the link below to join:

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.