Hi Members,

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

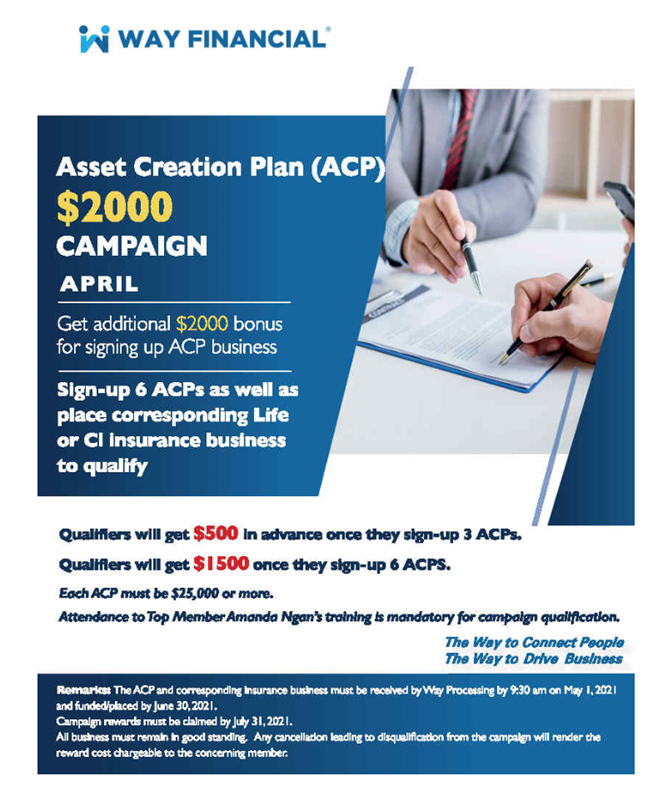

NEW ACP $2000 Campaign

ACP $2000 campaign has started in on April 1! Join Amanda’s training this Wednesday to be a qualifier for the campaign. Also book your 1-on-1s with her to learn how to close your cases and win this extra cash. Read the Poster for details.

New Business Compliance Forms

As announced in Annual Compliance Meeting on March 24, an updated version of the KYC with the new Investment Fund Sales Charge Disclosure are already available for use, especially for those of you who use Deferred Sales Charge (DSC) or Low Sales Charge (LSC) in your practice – make sure you have the signed Disclosure in your client’s files. The relevant Reason Why Letters are also updated. Please refer to the attachments, which can also be found on VirtGate.

Please see the six attached forms for your references. Fillable PDF version for the KYC will be available shortly.

Way’s Weekly Radio Talk Show – Connecting Talents「匯賢天下」

This week’s Connecting Talents 匯賢天下 has Stephen interviewing Simon Mok, Director of Seed Financial on how he was coached to be a financial planner and to grow the business from a seedling. His business keeps expanding by coaching potential members as well as clients. Tune in according to the schedule below to hear how Simon leverages the Platform resources to produce his business success.

AM1320 – 10:15am PST every Wednesday

AM1470 – 11:16am PST every Thursday

Upcoming Virtual Trainings

Time & Date: 11 :00am PST, Wednesday, Apr 7

Real Results: Using Other People’s Money to Create Wealth – Amanda Ngan

Learn from MDRT prospecting expert, Amanda, will tell you how to generate steady client streams. She will be teaching you how to generate new clients via ACP, a wealth creation strategy. Join the training as a prerequisite to win the upcoming $2000 ACP Campaign!

Time & Date: 11 :00am PST, Friday, Apr 9

NEW Canada Life Product: My Term – CL Carol Ng

New Canada Life My Term Insurance Product has arrived, with coverage period starting at 5 years! Click here to Learn more about Canada Life My Term and download the new illustration. Also join Carol Ng’s training at 11am this Friday to find out more details.

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

- Input your full legal name and email address when joining the training.

- Join the meeting on time to log the sign-in time.

- Leave the online meeting room only when the presenter confirmed that the training is over.

Upcoming 1-on-1 Case Studies (30 mins or 1 hour sessions available)

Time & Date: 10-11am, 2-5pm PST, Wednesday, Apr 7

1-on-1 Prospecting Studies with Amanda Ngan

Time & Date: 1-3pm PST, Friday, Apr 9

1-on-1 Case Studies with CL Carol Ng

Book your session online via the Way Platform Events calendar. Contact admin@wayfinancial.ca or 604-279-0866 if you have any question.

1-on-1 case studies can be 30 minutes or an hour each. Bring a case to get your desired results. All you need to bring is the client’s name and enquiry area. Examples include:

- How to present the case (illustrations & presentations help)

- How to respond to clients’ objections

- How to get repeated or referral business

- How to start the conversation

Carriers’ Updates

Canada Life

Insurance

New Canada Life My Term Insurance Product has arrived, with coverage period starting at 5 years. Click here to Learn more about Canada Life My Term and download the new illustration. Also join Carol Ng’s training at 11am this Friday to find out more details.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 or Aldous Lam at Aldous.Lam@canadalife.com or (604)443-8215 if you have any questions.

Investments

The current suspension on transfers out and redemptions from the real estate fund will be lifted and the fund will return to normal operations. This means investors can continue to purchase units of the fund or request a transfer or redemption of the value of their fund units on a daily basis. You may find out more by joining the webinar. Click here for registration.

Time & Date: 10am PST, Friday, Apr 9

The Canada Life Portfolio Manager Connect Series: conversations, opportunities and connections webinars are available for registration. You will learn from the portfolio managers, their expertise strategies and engage with them for questions. Click here for registration.

Time & Date: 10am PST, Thursday, Apr 15

Group Benefits

Please find the presentation file (CL_Canada Life Group Benefits ALL IN ONE_210331) for CL Jason’s training last Wednesday.

iA

The following webinars will teach how to enhance your clients’ assets and take advantage of participating life insurance with an integrated wealth management approach. Click here for registration.

For Individuals

Time & Date: 10am PST, Tuesday, Apr 20

For Corporations

Time & Date: 10am PST, Tuesday, May 11

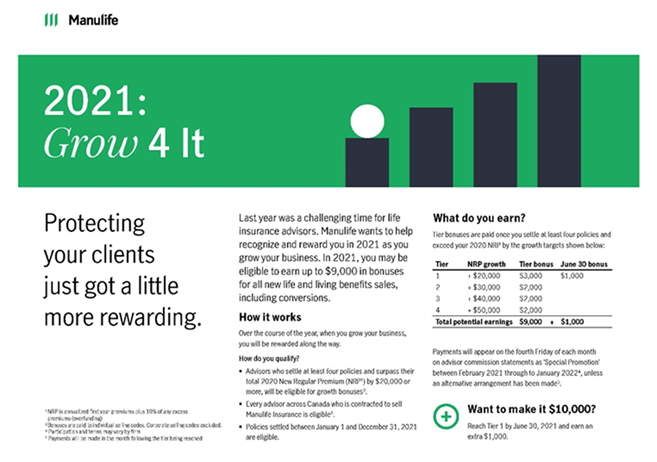

Manulife

Manulife’s Grow 4 It rewards program gives advisors up to $10,000 in additional bonus for settling insurance cases this year. Take a look at the attachment (ML 2021_Grow 4 It One-Pager_EN) for details or ask Chris Chang at chris_chang@manulife.com or at (604)355-4879 for more information.

News from the Insurance Council of British Columbia

2021 annual filing for all Insurance Council of BC licensees is now available. The deadline to complete your annual filing is June 1, 2021. Filing will be carried out through the Insurance Council’s Online Portal exclusively. The filing fee is $225 (including government fee). After June 1, all filings received will be subject to a late fee ($200) for a total of $425. Please be aware that any licences not renewed via annual filing by August 3, 2021, will be terminated automatically for non-filing. Annual Filing is completed through the Online Portal on the Insurance Council website. All new and current Insurance Council licensees have an account that will let them login to the Online Portal. Please click here for filling instructions and details.

New Continuing Education Guidelines will come into effect for all Insurance Council licensees starting June 1, 2021. Please click here for Continuing Education (CE) Guidelines.

Holiday Notice

Please note that our office will be closed on:

Monday, May 24, 2021 (Victoria Day)

Normal operations will resume on:

Tuesday, May 25, 2021

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

https://www.dreamifymedia.com/wayfinancial/

Greater Vancouver Area (GVA)

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

Greater Toronto Area (GTA)

Suite N500, 675 Cochrane Drive

North Tower, Markham, ON L3R 0B8

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.