3 Months Free Premiums (E) Sep

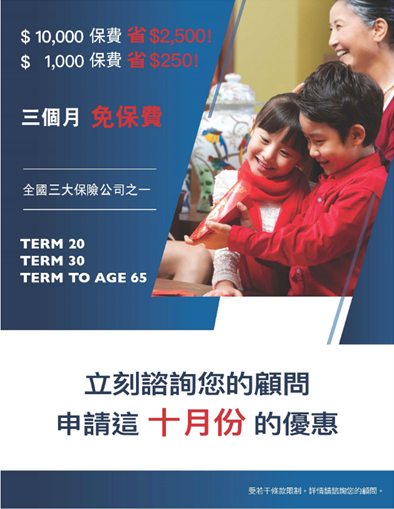

3 Months Free Premiums (C) Sep

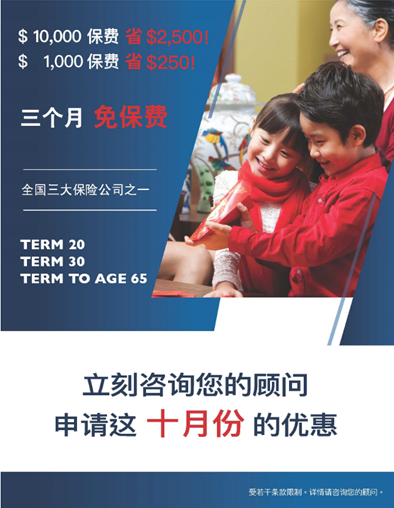

3 Months Free Premiums (SC) Sep

3 Months Free Premiums (E) Oct

3 Months Free Premiums (C) Oct

3 Months Free Premiums (SC) Oct

3 Months Free Premiums (E) Nov

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Reminder on Office Guidelines in Managing COVID-19

As the flu season arrives and given the latest announcements by health officials on the COVID-19 pandemic, we would like to remind all members to maintain the highest hygiene and safety measures to stay healthy and safe. Members must follow physical distancing protocol and wear a mask while at the office. Visitors must sanitize their hands upon arrival. Commercial sanitization of the office will be arranged this Friday and further instructions will be given to the office users shortly.

Persons who are not feeling well, have travelled outside Canada within the last 14 days, have been in contact with a person confirmed to have COVID-19 or have the following symptoms are asked not to come to the office:

For contact tracing purpose, please inform the Administration Department at admin@wayfinancial.ca if you have been exposed or diagnosed with the virus.

Our Operations Team continues to be at your service virtually:

2021 Calendars

Please be informed the 2021 calendar orders have arrived at the office. For members who have placed an order, please touch base with Administration Department to pick up your items.

Members say these calendars are useful tools in relation-building with their clients/prospects, generating referrals and enhancing their own reputation. Ask us about future orders.

Way has also ordered special calendars as a gift for our members wishing everyone good health and fortune in 2021. Come get yours at the office while supplies last.

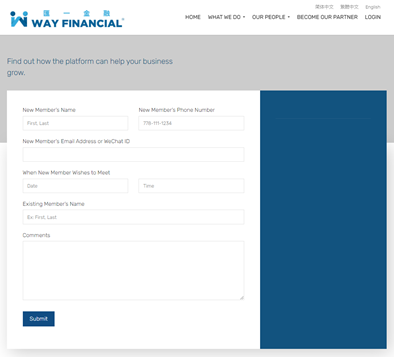

Connection Campaign – Advanced Bonus (October to November)

Last month to go to get your advanced bonus for your connections! Don’t wait, set-up your appointments now.

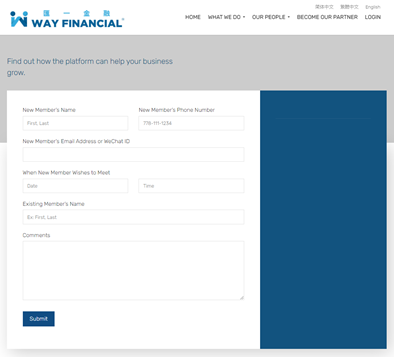

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

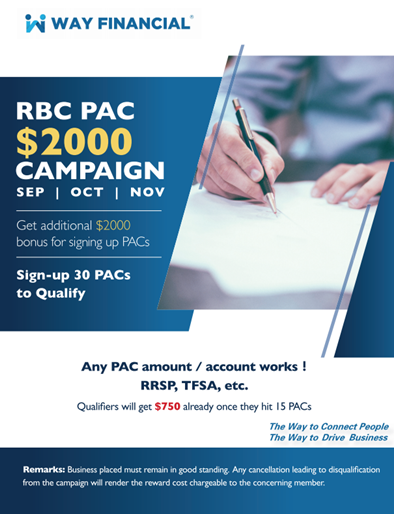

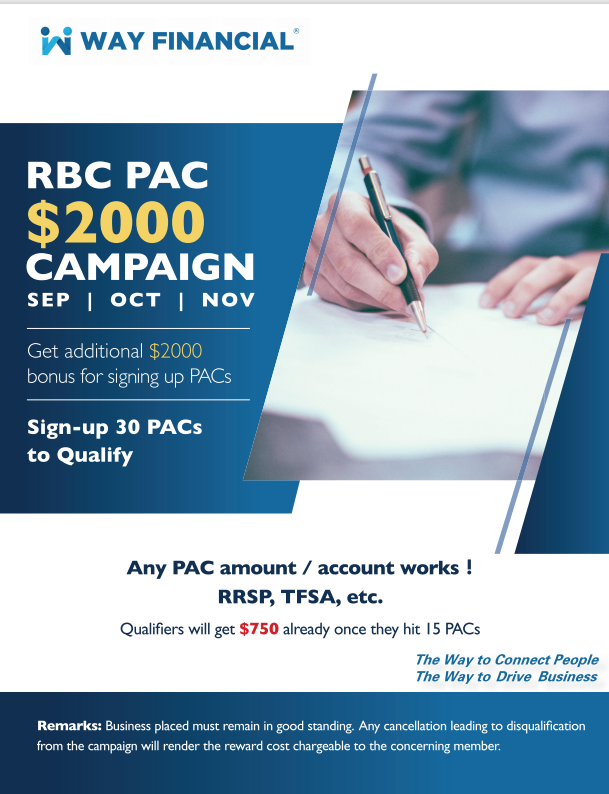

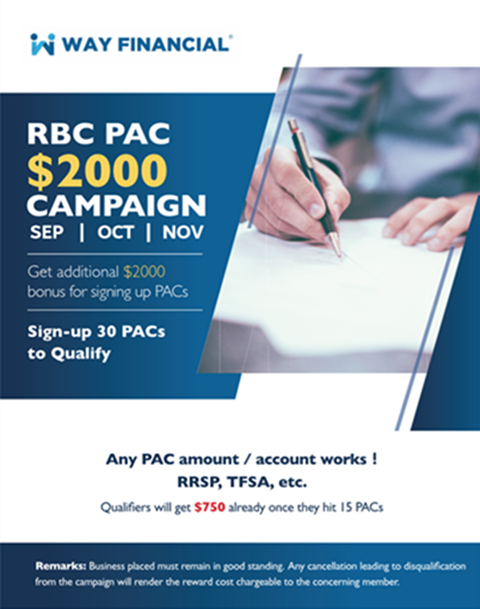

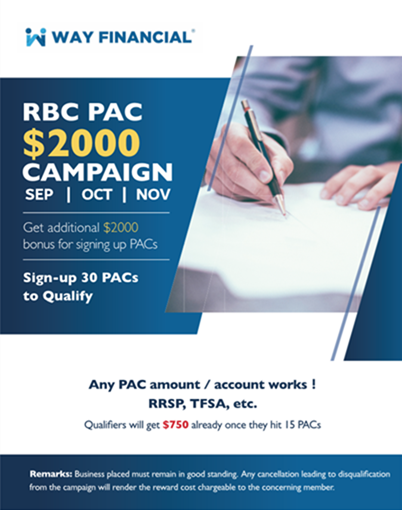

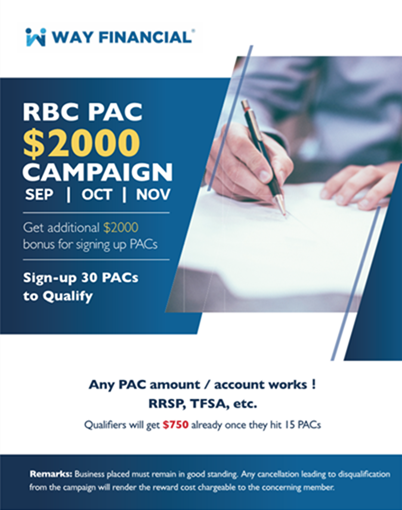

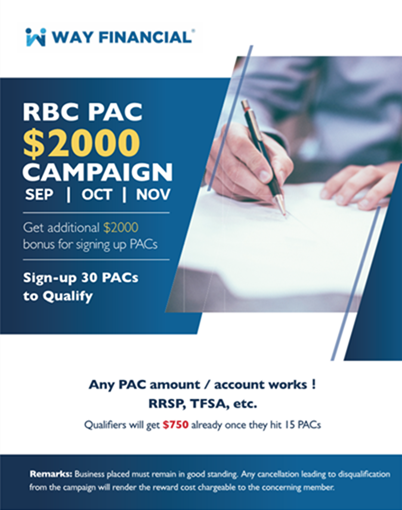

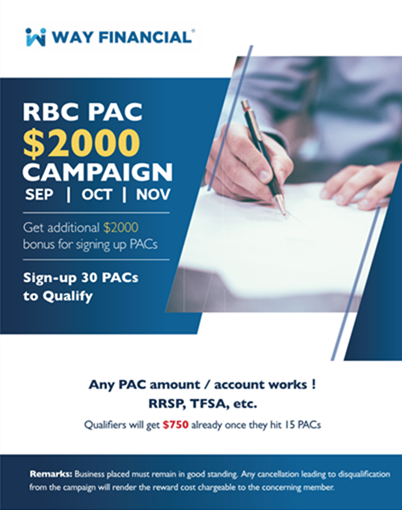

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

Only three more weeks left to get your $2,000 for the PAC Campaign!

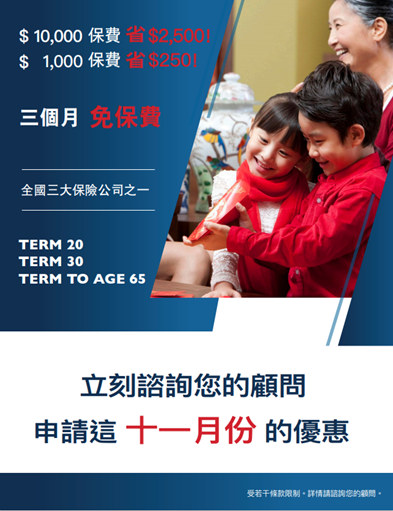

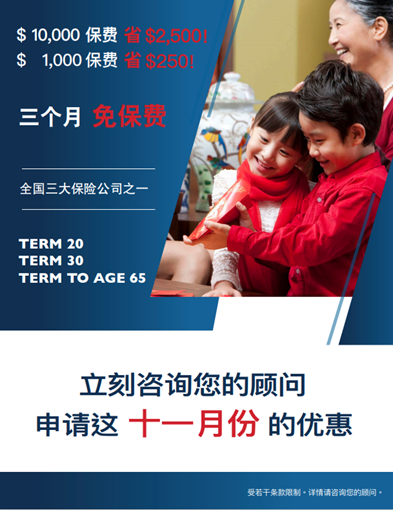

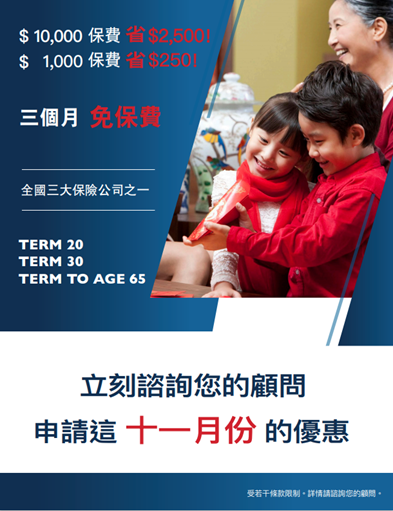

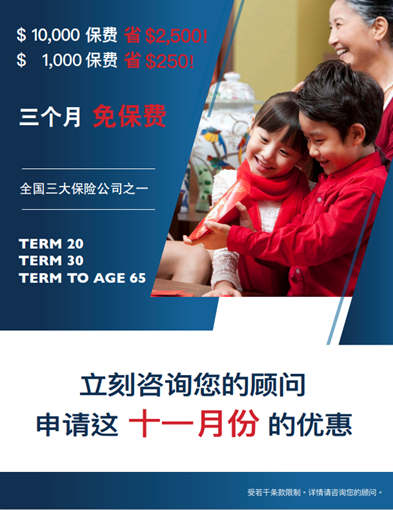

Marketing Poster for Canada Life 3-Months Free Premium Promotion (November)

The 3-months free premium promotion is ending soon. Remember, all business must be received between September 1st and December 1st inclusive. This offer extends to reissues, if the original policy qualified. The first premium must be paid for by the client for the contract to take effect.

Check out and utilize the attached and below posters for November:

Carriers’ Updates

Canada Life

Insurance

Check out the estate transfer+ tool to see how you can use permanent life insurance to preserve your clients’ capital and enhance net estate values.

Contact wholesaler, Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203 if you have any questions.

For those who missed the live Canada Life Day virtual event on October 28th, presentations are now available online and you can now stream each individual session on demand and earn CE credits. A short quiz will follow to confirm your understanding of the content.

iA

Investment

iAIM Weekly Fall Series

Webinar #5: U.S. stock market: perspectives and innovation themes

Time & Date: 8am to 8:30am, Wednesday, November 11th

Guest: Jean-Pierre Chevalier, CFA, Portfolio Manager, U.S. Equities (iAIM)

RBC

Investment

The presentation file for Mike’s training last Wednesday is attached for your reference.

Contact Mike Jackson at mike.jackson@rbc.com or (604)363-7583 or Matthew To at matthew.to@rbc.com or (604)219-0134 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

A Deeper Dive into Canada Life UL — CL Carol Ng, Jeff Nason & Richard Chen

11am, Friday, November 13th

CL Carol Ng will tell you how to put together a UL plan based on your client’s needs, what funds are available under UL contract and what are the fund recommendations.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

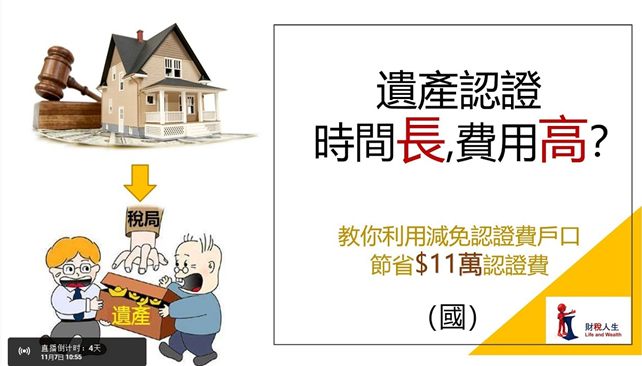

Client Events for Way Members

Way coordinates for client events that can be utilized by members to help you generate repeated and referral business, build your own reputation in your network, as well as stay connected with your clients. Don’t miss the upcoming sessions in November on high-in-demand topics:

12 Executor Tactics: #3 “Deprobate” Liquid Asset and #12 Long Term Care ROP

Special guest, RBC Mike Jackson, will be interviewed to talk about using segregated funds for estate planning purpose – this is a must-view session for a wide range of clients: those looking at wealth transfer and those who are helping their parents do estate planning.

Time & Date: 10:55 am, Saturday, November 7th

Language: Mandarin

Time & Date: 1:55 pm, Saturday, November 7th

Language: Cantonese

12 Executor Tactics: #7 Participating Cash Value and #10 Back to Back Charity

Time & Date: 10:55 am, Thursday, November 19th

Language: Mandarin

Time & Date: 1:55 pm, Thursday, November 19th

Language: Cantonese

Members who want to invite their clients can register with admin@wayfinancial.ca by indicating the session they are interested in and the names of their guests (don’t forget your own name!). Ask Administration if you have questions on Client Events for Way Members.

Connection Campaign – Advanced Bonus (October to November)

Last month to go to get your advanced bonus for your connections! Don’t wait, set-up your appointments now.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

Only four more weeks left to get your $2,000 for the PAC Campaign. Attend RBC Mike’s training at 10am, this Wednesday to learn how to generate Big Results from Small Amounts!

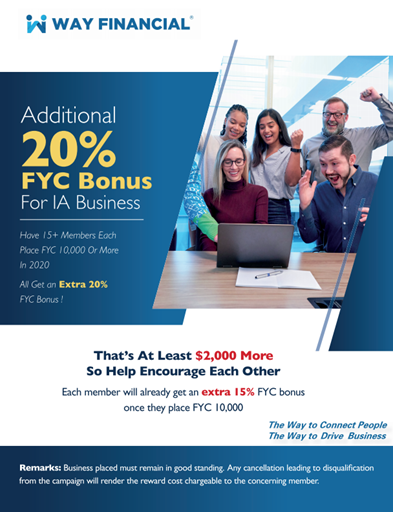

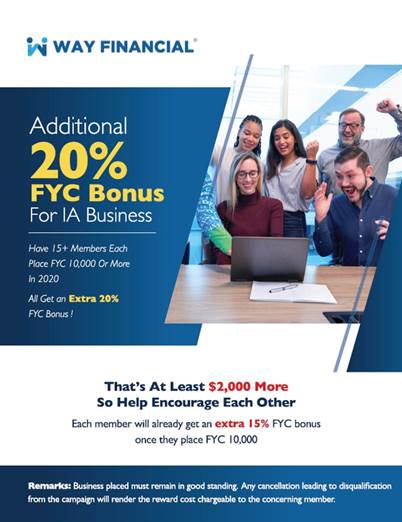

Additional 20% FYC Bonus Campaign for IA Business

Good job to the members who are now on track to getting the CPB this year: Anna Chen, Carmen Ke, Charles Ching, Darren Ng, Ella Chen, Esther Yu, Jack Lai, Jennifer Chan, Kenny So, Paddy Cheung, Patrick Ng, Peter Yeh, Shirley Lu, Sophia Fan, Sophia Li, Stanley Tsui, Wilson Ng and Yuki Ozawa, these members have about 2 more months to place a year total of FYC10,000 to get an additional 15% FYC bonus.

Remember all winners will get a further 5% making the total additional bonus to 20% if there are 15 or more qualifiers!

And for whose who’ve already qualified, doing more business means more total bonus for you.

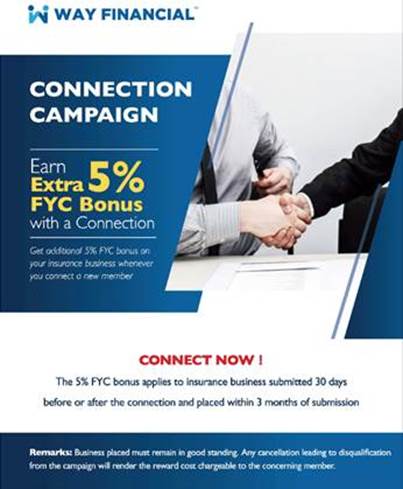

Connection Campaign 2020 – Earn Extra 5% FYC Bonus on Your Business with Every New Connection

Some members have indicated that business with clients has been slower this year due to the pandemic but don’t let the situation prevent you from growing your overall income. Connect with your external broker network and share with them the different resources you have from the Platform – marketing support, client events, unique trainings, exclusive campaigns, knowledgeable processing, etc., that they are currently lacking and get additional rewards for your connections!

Carriers’ Updates

B2B

B2B has extended its COVID-19 measures for loan applications below:

Until January 31st, 2021, B2B will allow:

Please include the EASE number in the subject line and only one client’s application and/or supporting documents per email.

Contact Danya Wang at danya.wang@b2bbank.com or (236)688-6201 for more details.

Canada Life

Insurance

Check out the financial tools here: https://planningtools.ca/ to help plan and meet your clients’ needs.

Contact wholesaler, Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or sales support, Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 if you have any questions.

Investment

Review Canada Life’s new wealth solutions and updates to target risk asset allocation funds on attached CL Risk-Managed Marketing Toolkit and CL Target Risk Asset Allocation Funds Toolkit.

Ask Richard Chen for more information at his webinar at 11am, Friday, November 27th.

Meanwhile, contact Richard Chen at richard.chen@canadalife.com or 604)338-6416 or internal wholesaler Jessica Leung at jessica.leung@canadalife.com or (604)335-3513 if you have any questions.

iA

Investment

iAIM Weekly Fall Series

Webinar #4: U.S. Presidential Elections: Reactions and what’s next?

Time & Date: 9am PST, Wednesday, November 4th

Guest: John Parisella, Senior Advisor, National Expert on American Politics

The presentation file for Hilda’s training last week is attached for your reference.

Contact Hilda at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

Small Amount, Big Result — RBC Mike Jackson

10am, Wednesday, November 4th

This is the last training from Mike during this campaign to help you qualify for the bonus.

LTC in View of COVID — SL Renee Ho

11am, Wednesday, November 4th

Listen to Renee’s presentation on changes to LTC coverage and how to promote LTC in view of COVID.

| https://sunlife.zoom.us/my/reneeho |

| Meeting ID: 123 200 4996 |

Preferred Solutions For Individuals — EQ Monica Zhang

11am, Friday, November 6th

Monica will share two case studies to explain using Par WL to offer client much better estate transfer value and retirement income than other investment tools. Sales concept illustrations is included.

Holiday Notice

Please note that our office will be closed on:

Wednesday, November 11th, 2020 (Remembrance Day)

Thursday, December 24th, 2020 (Christmas Eve, closes at 1:30pm)

Friday, December 25th, 2020 (Christmas)

Saturday, December 26th, 2020 (Boxing Day)

Thursday, December 31st, 2020 (New Year’s Eve, closes at 1:30pm)

Friday, January 1st, 2021 (New Year’s Day)

Normal operations will resume on:

Thursday, November 12th, 2020

Monday, December 28th, 2020

Monday, January 4th, 2021

Events Schedule – November (Updated)

The updated Events Schedule for November is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Reminder on Office Guidelines in Managing COVID-19

A friendly reminder to all members to continue observing the health guidelines on COVID-19 and to keep safe amidst the second wave of the pandemic.

We continue to practice physical distancing and maintain a mandatory mask wearing policy at the office, with visitors sanitizing their hands upon arrival. Fogging/commercial sanitization of the office will be arranged and advance notice will be given to the office users.

Persons who are not feeling well, travelled outside Canada within the last 14 days, who have been in contact with a person confirmed to have COVID-19 or have the following symptoms are asked not to visit:

For contact tracing purpose, please inform the Administration Department at admin@wayfinancial.ca if you have been exposed or diagnosed with the virus.

Our Operations Team continues to be at your service:

Compliance Reminder

Is your Business Compliant?

As an advisor, you’re obligated to operate a compliant practice and meet your regulatory and industry requirements such as Advisor Disclosure, Privacy Consent and suitability documentation. To demonstrate compliance with these requirements your client file must contain:

Additionally, advisors have regulatory obligations to keep:

Contact Stephen at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114 if you have any questions.

Connection Campaign – Advanced Bonus (October to November)

Many members are already making appointments to introduce their connections to the platform.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

Only five more weeks left to get your $2,000 for the PAC Campaign. Attend RBC Mike’s training next week (10am, Wednesday, November 4th) to learn how to generate Big Results from Small Amounts!

Marketing Poster for Canada Life 3-Months Free Premium Promotion (November)

As previously mentioned, the Platform has designed a poster for your use in promoting the Canada Life 3-Months Free Premium campaign. The poster is designed for members’ unique use so you would not see any logos, including Way’s, on it – feel free to add your own company logo to it. The wording is also intended to push for immediate action from clients. All business must be received between September 1st and December 1st inclusive. This offer extends to reissues, if the original policy qualified. The first premium must be paid for by the client for the contract to take effect.

PDF CL Term FAQ Final EN is attached for your reference.

Check out and utilize the attached and below posters for November:

Carriers’ Updates

Canada Life

Insurance

To make sure any document you submit with an eSignature is accepted the first time, review the attached CL E-signature Checklist and Q&A.

Why do I need to use an eSignature provider?

Obtaining client verification through non-face-to-face means is now a permanent process for all insurance products.

Review the attached CL NF2F Process Chart and CL Insurance Complete Guide for more information.

Contact wholesaler, Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or internal wholesaler, Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 if you have any questions.

Investment

Canada Life new wealth solution – Risk Managed Portfolios designed to help your clients is coming soon. New Risk-Managed Portfolios will be available for sale once the prospectus is approved by industry regulators on or around November 4th.

Check out the resources page to get ready and see what’s new.

Meanwhile, ask Richard Chen at richard.chen@canadalife.com or ((604)338-6416 or internal wholesaler Jessica Leung at jessica.leung@canadalife.com or (604)335-3513 if you have any questions.

iA

iA has informed us that they are making system updates to your Advisor Centre’s login so you temporarily may not able to see your clients’ account. We’re currently following up with iA to get this back on as soon as possible.

Contact the Processing Team at process@wayfinancial.ca if you have any questions.

Investment

iAIM Weekly Fall Series

Webinar #3: Bond market: where to go for safety?

Time & Date: 8am to 8:30am, Wednesday, October 28th

Guest: Alexandre Morin, CFA, Principal Portfolio Manager, Fixed Income

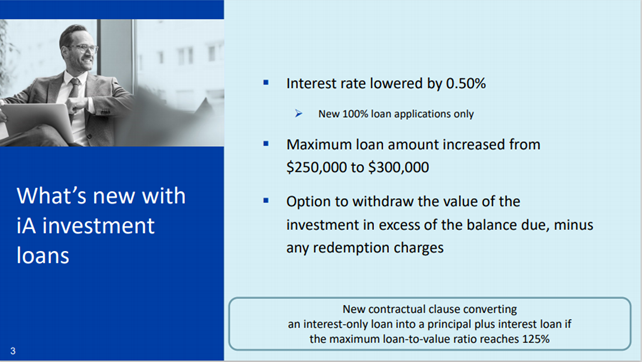

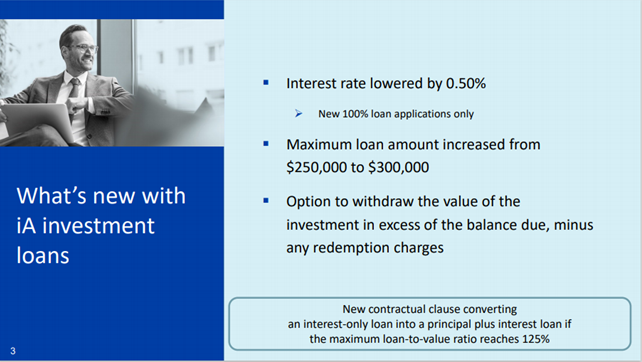

iA revamped investment loan program is here!

More information will be available at Hilda’s training at 11am, this Friday.

Meanwhile, contact Hilda at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

Canada Life Days – Registration is open

9:30am, Wednesday, October 28th

Join the sessions which include:

Prospecting Strategies: Turn Potential Prospects to Clients — Amanda Ngan

11am, Thursday, October 29th

MDRT prospecting expert, Amanda, will tell you how to generate steady client streams.

iA’s New Investment Funds and Investment Loan Program to Help You Do More Business — iA Hilda Ng

11am, Friday, October 30th

Don’t miss Hilda’s presentation on iA new funds and loan program.

Click on the link below to join:

https://us02web.zoom.us/j/84379499453?pwd=Ym0wZS81UERhRGQwdjZROEV2eEl2dz09

News from the Insurance Council of British Columbia

Disciplinary Decisions

Wah Shing Jacky Chan was disciplined for failing to meet the requirements of the Insurance Council’s continuing education program for three licensing years.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Connection Campaign – Advanced Bonus (October to November)

A few members have already qualified for the Connection Advanced Bonus by successfully connecting external brokers to the Way Platform. Some others are also on track by arranging appointments with the office to introduce their network to Way.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/

There are only 6 weeks left to this unprecedented campaign – don’t miss out.

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

New Text Templates for Prospecting Clients

Further to RBC’s training last Wednesday, the presentation and PAC Playbook are attached for your reference.

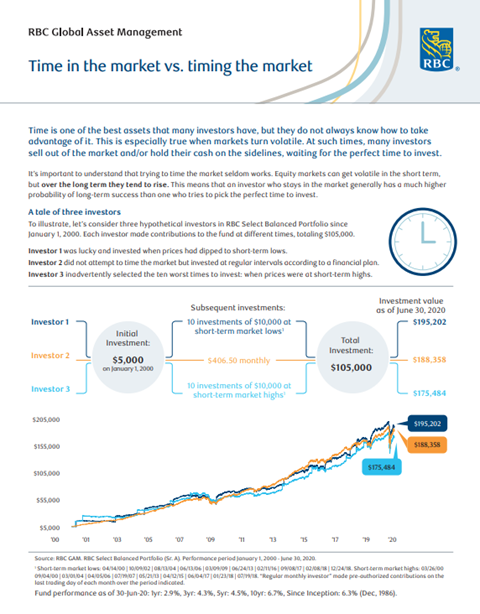

RBC has also provided a special marketing piece to reassure your clients during the current time of market volatility. This is a good door opener to start a PAC for them and get the additional $2,000 bonus from the current PAC Campaign!

Here are the text templates for you to send out to your clients along with the RBC piece:

Hi XXX, given the current sociopolitical events causing market volatility, I want to reassure you that investing at regular intervals is an effective and potentially less stressful approach to building wealth over the long run and during any type of market.

Check out the RBC advice below and I will call you shortly to help you with this.

XXX 你好,近期一連串的社會和政治事件,引致投資市場波動不已,因此我想向您重申,定期定額投資是一種最有效的長線投資方法,在任何類型的市場下都可以減低風險,積累財富,壓力也最少。

請閱讀下面RBC的建議,我會這週打電話給您,幫助您利用這種方案。

XXX您好,近期一连串的社会和政治事件,引致投资市场波动不已,因此我想向您重申,定期定额投资是一种最有效的长线投资方法,在任何类型的市场下都可以减低风险,积累财富,压力也最少。

请阅读下面RBC的建议,我会这周给您电话,帮助您利用这种方案。

Carriers’ Updates

Canada Life

Insurance

Download the new illustration (version 4.4) and see the full product and pricing details on attached CL PDFs.

Canada Weekly Call

Time & Date: 10am PST, Wednesday, October 14th

Speaker: Hugh Moncrieff, Executive Vice-President, Advisory Network and Industry Affairs, Carol Neuss, Assistant Vice-President and Chief Underwriter & Dr. Bruce Empringham, Medical Consultant, Advanced Advisor Practices

You will learn about what Canada Life is doing to help advisors build better businesses to serve Canadians and an update on underwriting processes.

Canada Life Days – Registration is open

Time & Date: 9:30am to 1:40pm PST, Wednesday, October 28th

Session include:

*Top Member Training on Prospecting Strategies by Amanda Ngan originally scheduled for the morning on the 28th will be rescheduled to the same time at 11am on Thursday, October 29th.

Canada Life SimpleProtect Demos

Time & Date: 10am PST, Tuesday, October 27th

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions you may have.

iA

iA Connected

Check out the different ways to post video content on your social media here.

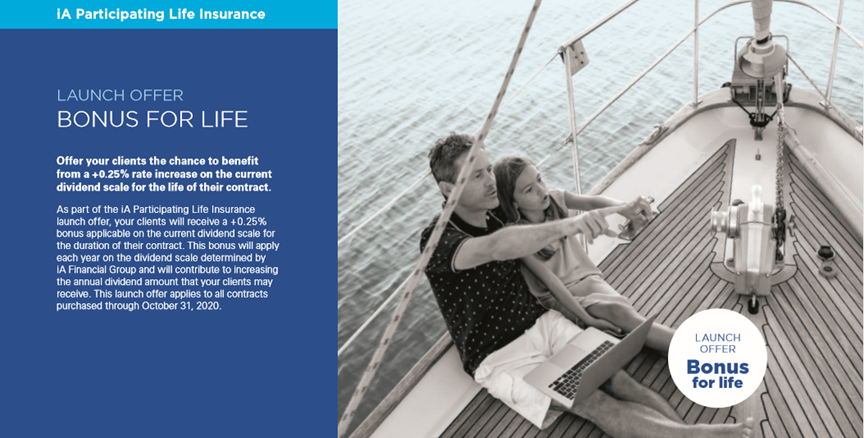

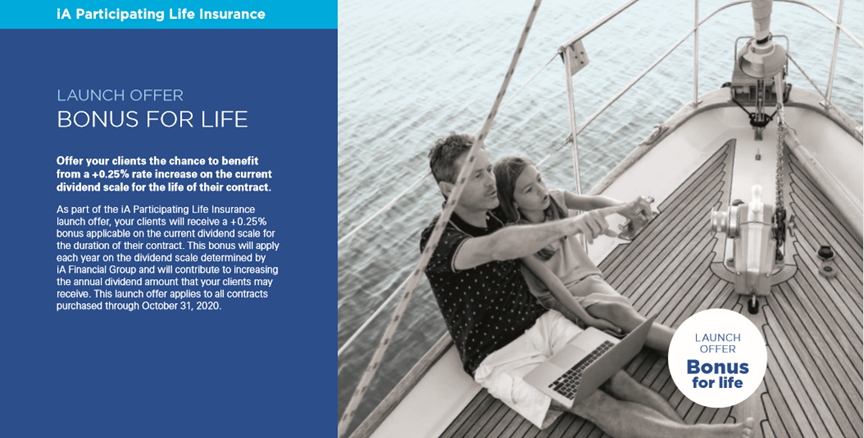

Remember the iA dividend bonus for clients will end this month on October 31st .

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for iA’s new Par and other life business, and Jackie Singzon at (604)220-7692 and Danielle Fairbank danielle.fairbank@ia.ca or (778)886-8492 for Critical Illness and Acci7 Hospitalization Benefit.

Investment

The iA weekly webinar series, hosted by Mr. Clément Gignac, Chief Economist, is back!

| iAIM Weekly Fall Series

Join this new series of webinars with weekly special guests every Wednesday at 8am which run until December 2nd. Webinar #1: Stock market: What’s in store for the rest of 2020? Time & Date: 8am to 8:30am, Wednesday, October 14th Guest: Marc Gagnon, Vice-President and Principal Portfolio Manager, North American Equities Contact Hilda Ng at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions. RBC For those who have missed the past RBC GAM conference calls, see below to listen to the recordings. RBC Global Equity – Q3 Update Speaker: Jeremy Richardson, Senior Portfolio Manager, Global Equities RBC Global Asset Management (UK) Limited. Jeremy has talked about the Q3 performance of his team’s funds, developments in the risk environment, summary of recent trading activity, and several potential paths forward for global equity markets. |

Listen to the recording here.

Emerging Markets Equities Update

Date: September 22nd

Speaker: Laurence Bensafi, Portfolio Manager & Deputy Head of Emerging Markets Equities, RBC Global Asset Management (UK) Limited.

Topics include:

Listen to the recording here.

Contact Mike Jackson at mike.jackson@rbc.com or (604)363-7583 or Matthew To at matthew.to@rbc.com or (604)699-2350 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

Real Life Case Studies: Advantages of PAC — Carmen Ke (Chinese; English available subject to the case client’s requirement)

11am, Wednesday, October 14th

Seg Funds and Estate Planning Update — ML Stefan Goddard

11am, Friday, October 16th

Click on the link below to join:

https://manulife-johnhancock.zoom.us/j/96685492814?from=msft

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Carriers’ Updates

Canada Life

Repricing of Disability Income and Universal Life plans effective October 13th:

Review the major changes in attached PDF CL DI & UL.

Make use of this last week to get the current rate for your clients!

A new illustration (version 4.4) will be available on October 13th, which includes product updates, pricing changes and software improvements.

New online CE-accredited courses now available:

Note: You can expect to receive your CE certificates by email within 7-10 days of successful course completion.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions you may have.

Equitable Life

Equitable Life is extending the Evidence of Insurability Requirements Temporary schedule until October 31st. See the attached temporary schedule and FAQ for your reference.

Contact Monica Zhang at mzhang@equitable.ca or (604)366-4314 for more details.

iA

Check out the new EVO version 2.4, effective October 5th and download it from here.

Remember the iA dividend bonus for clients will end on October 31st .

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for iA’s new Par and other life business, and Jackie Singzon at (604)220-7692 and Danielle Fairbank danielle.fairbank@ia.ca or (778)886-8492 for Critical Illness and Acci7 Hospitalization Benefit.

Manulife

Further to members’ request on past Friday’s training video, watch the recording here: How Business is Different with COVID-19 Changes in Asian Markets.

Here is a Mandarin third training recording on Manulife’s e-process and underwriting changes presented by Chris Chang for your reference: AMU01 – E-Processes and Underwriting Updates.

Chris can be reached at chris_chang@manulife.com or (604)355-4879 for more details.

Sunlife

Have you checked out the advisor’s best practices on Sunlife’s COVID-19 advisor resource hub? Click here to discover how the resource hub for client-focused advisors can help you from business building to marketing yourself, and client engagement to professional insights.

Contact Viola Lam at Viola.Lam@sunlife.com or (604)417-0791 or Renee Ho at renee.ho@sunlife.com or (604)657-9251 for any questions you may have.

Live webinar: Beyond Illustrations

Time & Date: 10am PST, Wednesday, October 21st

Join the webinar to understand the proper use of life insurance illustrations, comprehend how a dividend scale interest rate (DSIR) for Par insurance is constructed, and what factors are highly correlated to the DSIR.

Additional 20% FYC Bonus Campaign for IA Business

Earn Extra 5% FYC Bonus on Your Business

Get additional 5% FYC bonus on your insurance business whenever you connect a new member!

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

Advocis Practice Development Module 2A — Marketing

8:30am, Tuesday, October 6th

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

Lump Sum vs PAC: How to Compare — RBC Mike Jackson

10am, Wednesday, October 7th

Get your advance of $100 bonus by submitting 5 PACs and $200 bonus by submitting 10 PACs before this training session!

Top Members’ Training: Always Think Big — Sunny Chan

11am, Wednesday, October 7th

The spots for in-person participation for this session are open for registration – send an e-mail to admin@wayfinancial.ca to confirm your spot.

Permanent Life Insurance Options: A Deeper Dive into Participating Whole Life and Universal Life Insurance — CL Carol Ng

11am, Friday, October 9th

Join Carol’s presentation on permanent life insurance options to reach your business goals.

Holiday Notice

Please note that our office will be closed on:

Monday, October 12th, 2020 (Thanksgiving)

Wednesday, November 11th, 2020 (Remembrance Day)

Normal operations will resume on:

Tuesday, October 13th, 2020

Thursday, November 12th, 2020

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Virtual Client Events

#9 Individual Pension Plan; #12 Lifetime Capital Gain Exemption; #13 Purification; #1 Health Spending Account

Time & Date: 10:55 am, Saturday, October 3rd

Language: Mandarin

Time & Date: 1:55 pm, Saturday, October 3rd

Language: Cantonese

#3 Interest Deduction; #14 Passive Income Avoidance

Time & Date: 10:55 am, Thursday, October 15th

Language: Mandarin

Time & Date: 1:55 pm, Thursday, October 15th

Language: Cantonese

Speaker: Life & Wealth

Life & Wealth hosts a series of webinars for clients including Crisis Rebound Investment Secret Manual, RRSP Mistakes & Solutions amongst others. Contact Theresa Lai at 604-278-0122 (ext. 105) or theresa.lai@grandtag.ca for more details on how to participate and share the resource with your clients.

Marketing Poster for Canada Life 3-Months Free Premium Promotion (October)

As previously mentioned, the Platform has designed a poster for your use in promoting the Canada Life 3-Months Free Premium campaign. The poster is designed for members’ unique use so you would not see any logos, including Way’s, on it – feel free to add your own company logo to it. The wording is also intended to push for immediate action from clients. There will be a poster for each of the subsequent months of the campaign.

Check out and utilize the attached and below posters for October:

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

Congratulations to Wilson Ng who has already won $300 in advanced bonus and on track to the first tier of reward.

For other members, get your advance of $100 bonus by submitting 5 PACs and $200 bonus by submitting 10 PACs before Mike’s next training session on October 7th, at 10am!

Connection Campaign – Advanced Bonus (October to November)

Campaign will start in 3 days! Quite a few members are already making appointments to introduce their connections to the platform.

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

Apexa Onboarding

We are pleased to announce that Way’s Apexa account is already set-up and we will be inviting members to on-board the system shortly.

For those of you who are not familiar with Apexa, it is a digitalized platform to simplify contracting, consolidate advisors’ profiles and manage compliance risks all at once. It is a new requirement of our industry with carriers requesting that each advisor to have an Apexa account. With Way’s subscription, our members can utilize the service to make their business more efficient.

Our Contracting colleagues will be hosting training sessions to walk you through the set-up of your individual Apexa account. Several small training groups will be organized to make each session more effective. Look out for the invitation shortly.

You can find more information in the two attached Apexa PDFs. Go through the Tip Sheet to see what information you need on hand when creating your Apexa account.

If you have any question in the meantime, feel free to reach out to contracting@wayfinancial.ca.

Carriers’ Updates

Canada Life

Investments

Canada Life Wealth Live

Time & Date: 10am PST, Thursday, October 1st

Find out more about the direction of Canada Life wealth, including how they’re elevating their wealth product and distribution to help you and your clients succeed.

Further to members’ request on last Friday’s training presentation, attached is the file for your reference. Wholesaler Richard Chen can be reached at richard.chen@canadalife.com or ((604)338-6416 if you have any questions.

iA

Insurance

iA has enhanced their electronic signature in EVO which aimed at providing greater flexibility for your clients and a better user experience!

Two options are now available to your clients to access the documents to be signed:

See more detailed information here.

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for any questions you may have.

Hot Spots with Life & Living Benefits

Time & Date: 10 :30am PST, Monday, October 5th

Join Rishu Bains and Jacqueline Singzon as they bring you back into the game with key points to shine in your business with new flow for delivery, product solutions and instance acceptance!

Investment

iA has revamped its investment loan program with reduction in interest rates and highlights below:

More information will be available at Hilda’s training for Way members next month. Meanwhile, contact Hilda at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

iA Connected

iA has simplified insurance underwriting for clients aged 50 or younger. To benefit from this instant acceptance client experience, all it takes is to complete the personalized and simplified declaration of insurability on EVO. Telephone interviews are still required for clients who buy more than two million dollars in life insurance.

Click here to see the medical requirement chart, which includes the most recent updates, including the temporary easing standards applied because of COVID-19!

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

Par Whole Life for the Children’s market — EQ Monica Zhang

11am, Friday, October 2nd

Listen to Monica’s presentation on par for the children’s market.

Happy Mid-Autumn Festival & Early Office Closure

Please note that our office will be closed early at 1:30pm for Mid-Autumn Festival on Thursday, October 1st, 2020.

Wish everyone Happy Mid-Autumn and a lovely time with your family and friends.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Carriers’ Updates

Allianz

Allianz has launched the COVID-19 Insurance and Assistance Plan, a new stand-alone plan that covers emergency medical and quarantine expenses related to COVID-19. If your client tests positive for COVID-19 while travelling, this plan makes for an ideal complement to the Emergency Hospital and Medical and All-inclusive plans.

Join the live webinar sessions to learn more about what this plan has to offer should your clients test positive while travelling.

Contact Judi Kjartansson at judi.kjartansson@allianz-assistance.ca or (778)834-4282 if you have any questions.

Apexa

Some advisors have started migrating to the Apexa system to manage their contracts and compliance requirements. Look out for your invitation where Way’s Contracting Team will help you either create a new account if you are new to the system or merge your existing one.

Contact the Contracting Team at contracting@wayfinancial.ca if you have any questions.

Canada Life

New Insurance Internal Wholesaler, Fei Kong, is now on board to support your business with Canada Life. Along with Carol and Hinris, Fei can help on illustrations, sales concepts, product training and questions, positioning and sales ideas, preliminary underwriting inquiries and pending business questions.

The wholesalers’ contact information are as follow:

| Carol Ng | Carol.Ng@CanadaLife.com | (604)377-7203 |

| Hinris Chan | Hinris.Chan@canadalife.com | (604)443-8247 |

| Fei Kong | fei.kong@canadalife.com | (778)859-2515 |

Desjardins

A new business campaign is launched with Desjardins that runs until the end of this year! Get a $25 gift card for each life or CII case submitted and placed! Ask admin@wayfinancial.ca if you have any question.

Contact Lori Hartery at lori.hartery@dfs.ca or (604)346-5600 or Andrew McLeod at andrew.mcleod@desjardins.com or (778)231-9254 if you have any questions.

iA

Investment

iAIM Weekly Fall Series

Webinar #2: Investing overseas: Where are the opportunities?

Time & Date: 8am to 8:30am, Wednesday, October 21st

Guest: Pierre Chapdelaine, CFA, Principal Portfolio Manager, International Equities (iAIM)

Contact Hilda Ng at hilda.ng@ia.ca or 236-688-6201 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245 if you have any questions.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

Advocis Practice Development Module 3A — Prospecting

8:30am, Tuesday, October 19th

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

See attached Advocis Module 2 Activity Sheet to refer to during the training.

Business Management on Plan Your Year End Tax In Advance – Stephen Lai

11am, Wednesday, October 21st

Wealth Transfer Using IA PAR — iA Rishu Bains

11am, Friday, October 23rd

Click on the link below to join:

https://us02web.zoom.us/j/83959413046

Events Schedule – November

The Events Schedule for November is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Connection Campaign – Advanced Bonus (October to November)

As Stephen has announced at his training last Wednesday, this Connection Advanced Bonus Campaign will start in October and runs for only two months. The Advanced Bonus is paid out to every and each Connection made in October and November – get $1,000 per Connection made and double the bonus when you make 3 or more connections.

2 Connections = $2,000; 3 Connections = $6,000; 5 Connections = $10,000

As per members’ request, Stephen’s presentation file is attached for your reference on why it is easy to Connect and how to do so effectively! Let’s make use of this campaign to make up for any income loss from COVID this year!

When you have a potential connection, simply input their names and information on the bottom part of Way’s homepage to get started: https://www.dreamifymedia.com/wayfinancial/

Feel free to ask Stephen for more details at stephen.lai@wayfinancial.ca or 604-279-0866 ext. 114.

Marketing Poster for Canada Life 3-Months Free Premium Promotion

As previously mentioned, the Platform has designed a poster for your use in promoting the Canada Life 3-Months Free Premium campaign. The poster is designed for members’ unique use so you would not see any logos, including Way’s, on it – feel free to add your own company logo to it. The wording is also intended to push for immediate action from clients. There will be a poster for each of the subsequent months of the campaign.

Attached is the English one for September. The two Chinese versions will be available shortly and circulated in the WeChat group.

New Top Member Trainer – Amanda Ngan

The Platform is proud to present a new Top Member Training Series, featuring Amanda Ngan, an MDRT Prospecting Expert, who will present her experience and strategies on converting networks to clients and generating referrals every 4th Wednesday of the month.

Amanda started in the industry 10 years ago while still in school studying Finance at UBC. With a strong passion for asset management and helping clients do solid financial planning, she worked hard and smart, and soon after her graduation, she was already qualified as a Million Dollar Round Table (MDRT) member.

Born and raised in Vancouver, Amanda has been able to build and expand a solid network of clients from various backgrounds and help them reach their financial goals. This is also due to her strong prospecting & client conversion system, which she will share with you to turn your existing network into insurance/investment clients.

Amanda is also available for 1-on-1 sessions to help you directly. The sessions for this month are already full but reach out to admin@wayfinancial.ca to get the next spot available.

See you this Wednesday (September 23rd), either in person (please confirm spot with admin@wayfinancial.ca) or online (Join Microsoft Teams Meeting).

Apexa Onboarding

We are pleased to announce that Way’s Apexa account is already set-up and we will be inviting members to on-board the system shortly.

For those of you who are not familiar with Apexa, it is a digitalized platform to simplify contracting, consolidate advisors’ profiles and manage compliance risks all at once. It is a new requirement of our industry with carriers requesting that each advisor to have an Apexa account. With Way’s subscription, our members can utilize the service to make their business more efficient.

Our Contracting colleagues will be hosting training sessions to walk you through the set-up of your individual Apexa account. Several small training groups will be organized to make each session more effective. Look out for the invitation shortly.

You can find more information in the two attached Apexa PDFs. Go through the Tip Sheet to see what information you need on hand when creating your Apexa account.

If you have any question in the meantime, feel free to reach out to contracting@wayfinancial.ca.

Carriers’ Updates

Assumption Life

Check out the new illustration effective September 18th, 2020 and download it from the page here with attached instructions.

Contact Mohammed Saiepour at mo.saiepour@assomption.ca or (403)542-5209 for more details.

Canada Life

Canada Life SimpleProtect Demos

Time & Date: 10 to 11am PST, Thursday, September 24th

Agenda:

Make sure you know how to use SimpleProtect to make use of the 3-months free premium promotion and quickly close cases.

iA

Investments

It is now possible to obtain, in just a few clicks, a list showing the fund performance for your block of business, presented by client, for the period you select.

See here for more information.

Contact Hilda Ng at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245.

iA Connected

Did you know you could have your clients schedule appointments with you using Facebook? Click here to see how you can set up the appointments on your page.

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for any questions you may have.

RBC

Did you know you can use annuities calculator to estimate a client’s money required at retirement? For example, if your client is 50 years old, currently has $200,000.00 in savings and would like to receive $2,000.00 a month, you can estimate the total amount they require at retirement using an annuity illustrator and the required rate of return for their investments.

Check out the RBC Illustrator here https://www.rbcinsurance.com/cgi-bin/cannex/illustrations.cgi.

Ask Mike more about this at his presentation this Wednesday, September 23rd.

For those who missed the RBC Global Investment Outlook Conference Call on economy, equity and fixed income markets on September 2nd, see the presentation here.

TuGo

TuGo has now extended the offer to purchase 15 months of Multi Trip Annual Insurance for the price of 12, to the end of the year until December 31st, 2020. This offer applies to new sales, renewals and auto-renewals. Travellers have the flexibility to buy up to 1 year in advance of their trip start date.

For example, a customer can buy a Multi Trip Annual policy on September 30th, 2020, even if they don’t have plans to travel until March or June, or even September 2021. This means you can help secure your customers’ future travel coverage at the best rates possible!

Contact Hélène Desjardins at hdes@tugo.com or (180)069-7752 ext. 3501 for any questions you may have.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

Module 1B – Business Planning/Mentor Input

8:30am, Tuesday, September 22nd

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

Why PAC Works the Best for Long Term Investors — RBC Mike Jackson

10am, Wednesday, September 23rd

Get your advance of $100 bonus in this campaign by submitting just 5 PACs before this second training session! Stephen will also be announcing an additional advanced bonus at the session on Wednesday. Attendance to this training session is mandatory as a requirement for the $2,000 PAC Campaign.

Canada Life Retirement Solutions: Lifetime Income Benefits — CL Richard Chen

11am, Friday, September 25th

Learn about lifetime income benefits from Canada Life Richard.

Events Schedule – October

The Events Schedule for October is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.

The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Advocis Practice Development Series (September 2020 to November 2021)

Way is providing an extra training resource to our members by offering the Advocis Practice Development series, focusing on skills and knowledge for newer advisors to further your development and ensure success in the industry.

There are 12 modules and will be held monthly until November 2021. Each module is delivered in two parts, a facilitated session and a mentorship session. The mentors are Advocis members who have built successful practices over numerous years in the industry, through many market cycles, and are looking forward to sharing their experiences with you. These sessions are open without cost to members.

The first session starts tomorrow with details below:

Module 1A – Business Planning, Facilitated Session

Time & Date: 8:30 to 10am PST, Tuesday, September 15th

See attached Advocis Module 1 Activity Sheet to refer to during the training.

RBC PAC Campaign 2nd Series – $2,000 Lump-Sum Bonus (September to November 2020)

Get your advance of $100 bonus in this campaign by submitting just 5 PACs before Mike’s next training session on September 23rd, at 10am!

Carriers’ Updates

Please find below the latest guidelines of the carriers’ new business processing requirements:

Feel free to ask Stephen at stephen.lai@wayfinancial.ca or (604) 279-0866 ext. 114 or reach out to the relevant wholesalers if you have any questions:

Canada Life

Review the attached CL Insurance Complete Guide for details on underwriting, paramedical, non-face-to-face business and more.

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions you may have.

For investment business inquiries, contact Richard Chen at richard.chen@canadalife.com or (604)338-6416 or Floria Song at floria.song@canadalife.com or (604)331-2420.

Canada Life Weekly Call

Time & Date: 10 to 11am PST, Wednesday, September 16th

Speaker: Jeff Macoun, President and Chief Operating Officer, Canada & Steve Marino, Senior Vice President, Portfolio Management

In addition to the Canada Life’s new term promotion, Jeff will be sharing what they have been able to accomplish in Q2 along with how their new products will help you meet the needs of your customers.

For those who missed the webinar on August 5th on an overview of what government support is available to small business owner and how much of an impact it has had to help keep business doors opens, watch the recording here.

Equitable Life

Review the attached EQ EZcomplete Remote Signing Process and click here for the latest update on non-face-to-face delivery process and underwriting guidelines.

Check out the new illustration effective September 11th, 2020 and download it from the page here on EquiNet.

Contact Monica Zhang at mzhang@equitable.ca or (604)366-4314 for more details.

iA

Review attached PDF iA Doing Business Virtually – Updates for e-delivery process and non-face-to-face information.

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for any questions you may have.

For investment business inquiries, contact Hilda Ng at hilda.ng@ia.ca or (778)873-1254 or Barbra Vuan at barbra.vuan@ia.ca or (604)737-9245.

iA Connected

Learn how to increase your number of Facebook subcribers with these two simple tricks: https://iaconnected.ia.ca/.

Manulife

See attached ML E-Signature for Clients and Advisors (by email) for relevant information.

Criteria to qualify for e-delivery includes:

Insured age: 18 to 60

Term: Up to including $5,000,000.00 in total coverage

Critical Illness, Universal Life, Whole Life and Synergy: Up to $1,000,000.00 in total coverage

Contact Chris Chang at chris_chang@manulife.com or (604)355-4879 or attend his training this Friday to ask him on questions you may have.

For investment business inquiries, contact Stefan Goddard at stefan_goddard@manulife.ca or (778)954-9685 or Nathan Ma at nathan_ma@manulife.com or (604)664-8041.

Sun Life

Sun Life has a COVID-19 Advisor Hub and to access these underwriting guidelines, click here to log on. In brief:

For long term care insurance:

For life insurance:

Contact Viola Lam at Viola.Lam@sunlife.com or (604)417-0791 or Renee Ho at renee.ho@sunlife.com or (604)657-9251 for any questions you may have.

For investment business inquiries, contact Ryan Cipolla at ryan.cipolla@sunlife.com or (604)353-0392 or Brock Chatterley at brock.chatterley@sunlife.com or (604)235-9045.

Upcoming Virtual Trainings

Please note the sign in and out times are stamped by online training apps (MS Teams, Zoom and etc.) automatically when the meeting starts and before the meeting end. In order to ensure that you are entitled to the CE credits earned of a training, some carriers have advised the following guidelines:

Business Management on Ways to Generate Bonus by Connections — Stephen Lai

11am, Wednesday, September 16th

Stephen will be announcing a new campaign to help members make up for income loss because of COVID-19 this year with a simple product. Come in-person or join virtually to see how you can make several thousand dollars over the next 2 months.

Send an e-mail to admin@wayfinancial.ca to confirm your in-person spot.

How Business is Different with COVID-19 Changes in Asian Markets — ML Chris Chang

11am, Friday, September 18th

Don’t miss the presentation from Manulife Chris on doing business in current situation and Asian market.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.