The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

New Specialized Training – Focus Group on Corporate Cases

Further to the 9 Classes Scaling Strategies to Generate Corporate Clients, an intermediate class to further your business and sales techniques will be organized to support those members who are committed and have taken action to doing corporate cases. Here is a preview of the 6 topics for this Focus Group:

| Date

(Time: 10am to 12pm) |

Speaker | Topic |

| Sep 1 | Leon Chan, CPA, BBA,

Wealth & Tax Planning Consultant |

Corporate 101 whiteboard session & insurance planning opportunities |

| Sep 8 | Leon Chan, CPA, BBA

Wealth & Tax Planning Consultant |

Fact finding and optimized discussions with high net worth clients |

| Sep 15 | Jeff Nason, BA, EPC, CHS, CFP, CLU, Advanced Case Consultant

Tim Lau, CFP, CLU, TOT |

Bridging the gap: From Fact-Find to Solution-Selling |

| Sep 22 | Jeff Nason, BA, EPC, CHS, CFP, CLU, Advanced Case Consultant | Corporate Asset Efficiency – Putting the pieces together |

| Sep 29 | Tim Lau, CFP, CLU, TOT | Inter-Generation Tax Saving ITSP

Biggest CII Objection: Is it Worthwhile to Apply if There is No Illness Diagnosed |

| Oct 6 | Patricia Carlos, BA, CHS,

Advanced Planning Strategist, Living Benefits |

Solution Selling: Strategies to Protect the Business Owner |

This Focus Group is open without cost to committed members. More details on the eligibility will be available in due course and please reach out to Stephen Lai to indicate your interest and find out if you are eligible, at stephen.lai@wayfinancial.ca or (604) 279-0866 ext. 114.

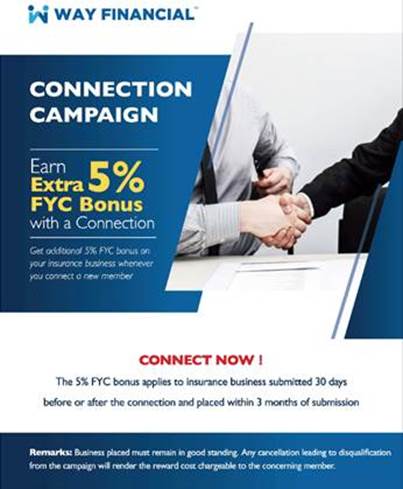

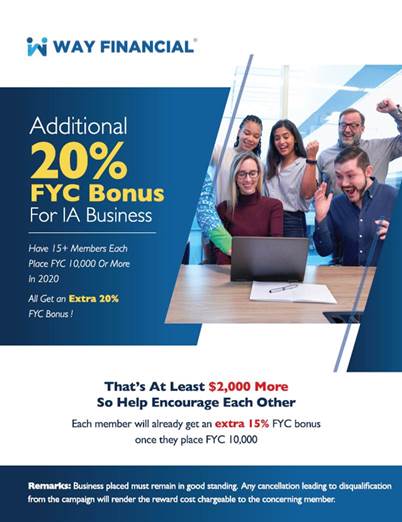

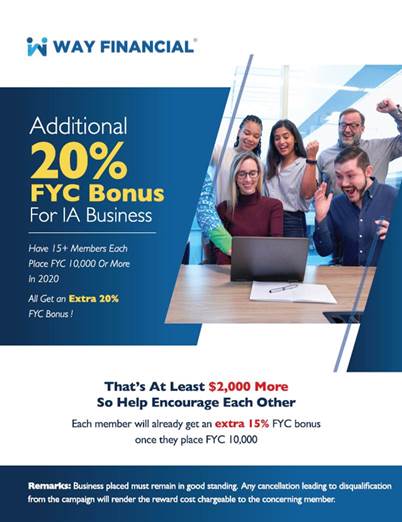

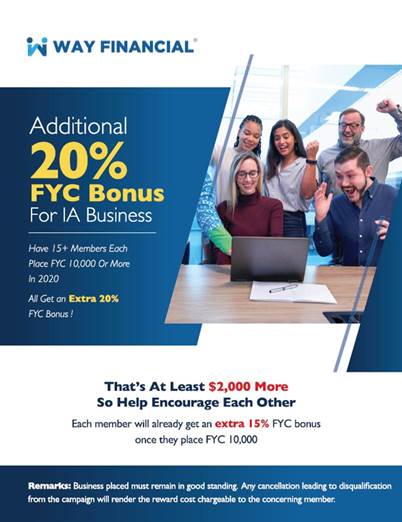

Additional 20% FYC Bonus Campaign for IA Business

We are pleased to announce that Darren Ng has already achieved the CPB target and is on track to getting an additional 20% FYC bonus! Congratulations, Darren, the more business you submit, the more additional commission you will be getting.

Others including Carmen Ke, Ella Chen, Esther Yu, Grace Zhu, Jack Lai, Kenny So, Patrick Ng, Sophia Fan, Stanley Tsui, Wilson Ng, and Yuki Ozawa are all in the run for the additional bonus.

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for iA’s new Par and other life business, and Jackie Singzon at (604)220-7692 and Danielle Fairbank danielle.fairbank@ia.ca or (778)886-8492 for Critical Illness and Acci7 Hospitalization Benefit.

Carriers’ Updates

Canada Life

Brush up on your non-face-to-face business practices by joining the following webinar:

Time & Date: 10 to 11am PST, Thursday, July 9

For those who attended the live Canada Life Day virtual MGA event on June 17th. The presentations of those sessions are now available to be viewed online.

If you missed the live event, you can now stream the individual sessions on demand and earn CE credits. Hear from experts about the latest on insurance, wealth management, living benefits and more.

- Welcome and opening remarks (Mandarin)

- Life: Canada Life participating life insurance: Built for times like these (Mandarin)

- Living benefits: Setting you up for success (Mandarin)

- Advanced sales strategy: Tax planning in recessions and bear markets (Mandarin)

- Wealth: Canada Life segregated funds – continuing to enhance the competitive nature of our shelf (Mandarin)

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions you may have.

Dynacare

Dynacare has just announced that they have resumed in-home visits and will continue providing fixed facility visits as an option.

Click here for more information.

iA

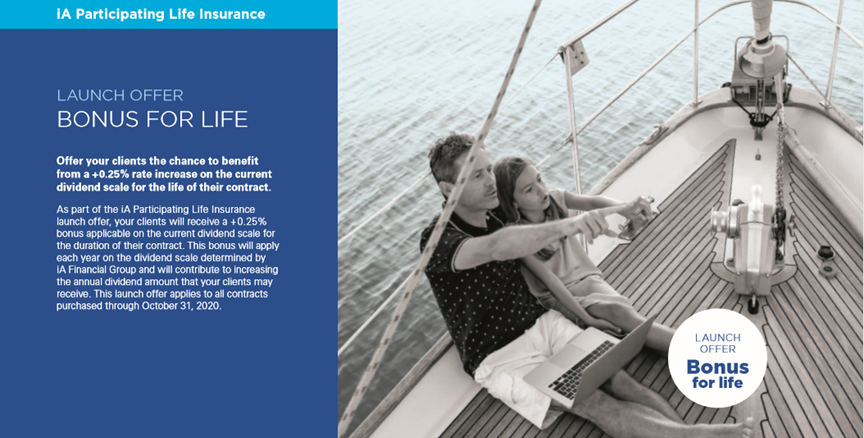

Remember, there’s a dividend incentive of 0.25% for the life time of the client contracts for par policies submitted by October 31st, 2020. Some members have already utilizing the new iA Par for bonus promotion. See the attachments for more information.

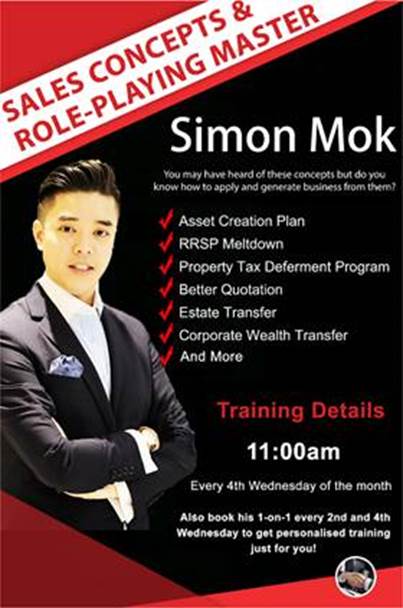

Upcoming Virtual Trainings

Please note when you sign in to the virtual trainings, make sure you use your legal name so the organizer can recognize you and have applicable CE credits issued accordingly. If requested by the speaker, please type in your name and e-mail address in the chat box to have your attendance recorded properly.

IA EVO Extranet, Business Tracker & E-delivery Process — IA Katrina Apodaca

10am, Wednesday, July 8th

Join IA’s presentation hosted by Katrina Apodaca on the new updates on apps and delivery processes .

Click on the link below to join:

https://us02web.zoom.us/j/83216404840

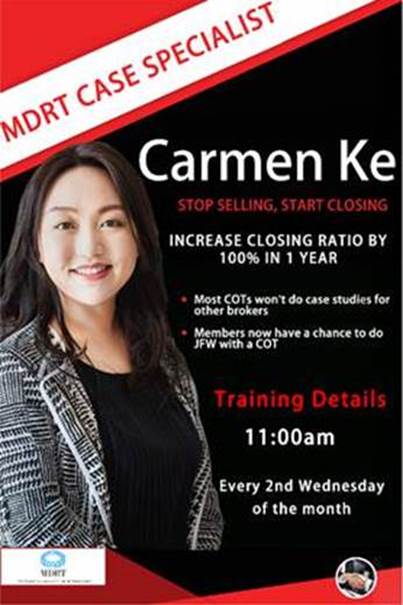

Real Life Case Studies: How do I Start Conversation with Client on Corporate CI Shared Ownership

11am, Wednesday, July 8th

Learn from the best and have MDRT Member, Carmen Ke, help you increase your closing rate and teach you tactics in dealing with different clienteles.

Click on the link below to join:

https://us02web.zoom.us/j/85081464860?pwd=VzFoV3h3QTJvR2NYbGllY0grSWZ0QT09

Setting Up for Success in the Mid-market with Canada Life CI — CL Carol Ng

11am, Friday, July 10th

Join CL’s presentation on how to set up success in the mid-market with CI.

Click on the link below to join:

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.