The weekly bulletin informs members recent initiatives, campaigns and more, so check it consistently to stay up-to-date with ways to grow your business.

Carriers’ Updates

Canada Life

Insurance

Here is a useful summary guide on doing insurance business with Canada Life amidst the pandemic: relaxed underwriting, return of paramedial services, non-face-to-face processing and more:

Your complete guide to doing Canada Life insurance business

Brush up on your non-face-to-face business practices by joining the following webinar :

Time & Date: 10 to 11am PST, Thursday, June 25

Contact Carol Ng at Carol.Ng@CanadaLife.com or (604)377-7203, or Hinris Chan at Hinris.Chan@canadalife.com or (604)443-8247 for any questions you may have.

Investment

DSC/LSC is no longer an option for leveraged investments – Any application disclosing a leveraged investment with a DSC/LSC purchase option, received on or after July 6th, 2020, will be returned to the advisor for selection of an alternative option.

Contact Richard Chen at richard.chen@canadalife.com or (604)338-6416, or Floria Song at floria.song@canadalife.com or (604)331-2420 for any questions on the change.

Equitable Life

Please see the attached guidelines on approved e-signature procedures, including the programs allowed: EQ 1886 Signing Requirements

A summary of the temporary underwriting requirements during COVID-19 is also included here Evidence of Insurability Schedule – Underwriting Requirements (Temporary).

Ask Monica Zhang at mzhang@equitable.ca or (604)366-4314 for more information.

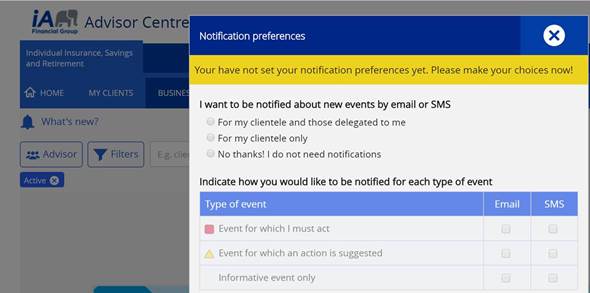

iA

Insurance

See the attached presentation file and Par Bonus material from last week on Par Q&A and Sales Concepts. Some takeaways include:

- 0.25% Guaranteed Incentive for new contracts submitted for lifetime of the policy From June 8th till Oct 31st, 2020

- 5.75% dividend

- Min $25K coverage with initial high death benefit purchase competitivity

- Strong in Guaranteed Cash Values after 20 years

- Very competitive in Total Cash Values around retirement & life expectancy

- Strong ADO Room with stop and go flexibility without medical evidence

- EVO for online application with Instant Acceptance program

- CPB – Year 1 – additional 15%

- VIP case limits are the lowest – $5000 Annual Premium only

- Superior Risk Program applies to Par as well

- 7 reinsurers vs industry

Electronic delivery of insurance contracts is also now available. Click here to find out more: https://covid-advisor.ia.ca/individual-insurance-electronic-contract-delivery-is-now-possible.

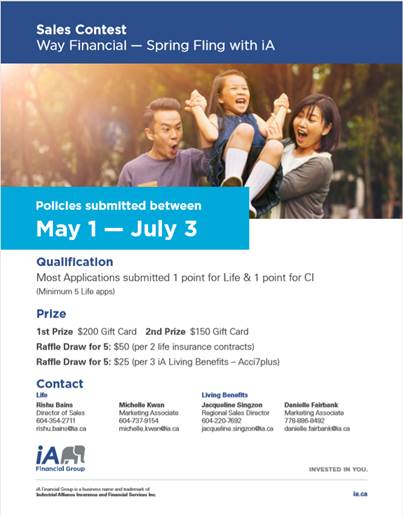

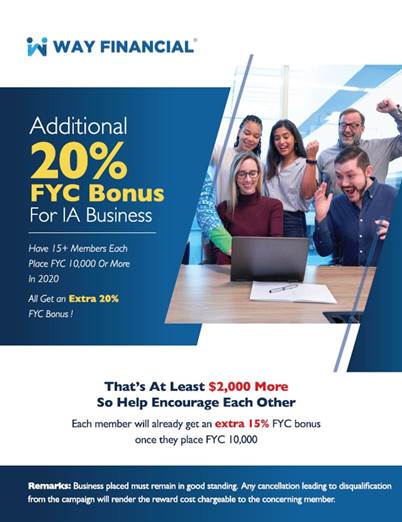

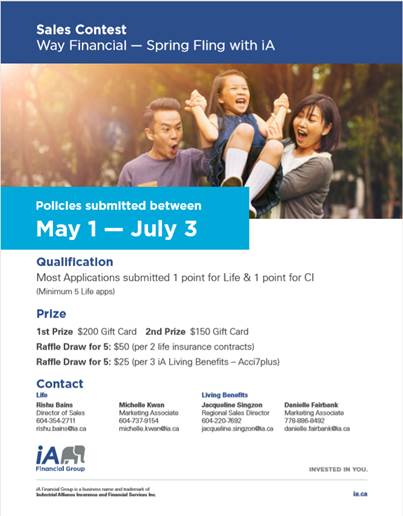

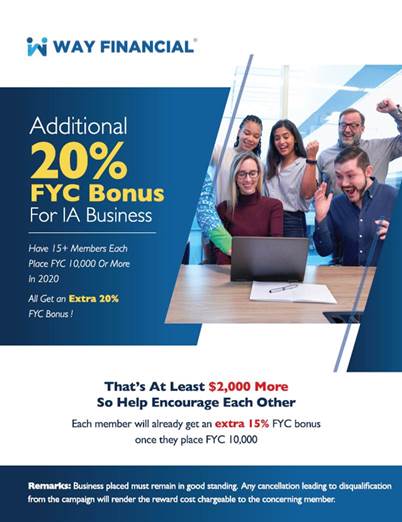

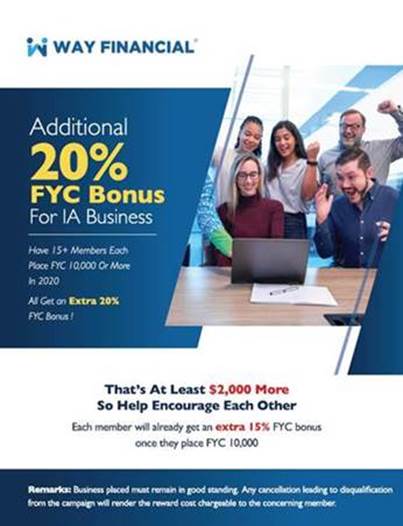

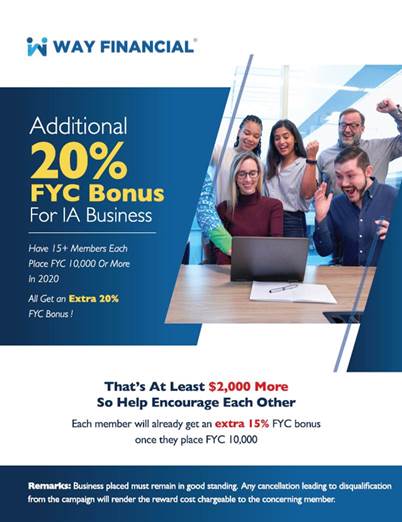

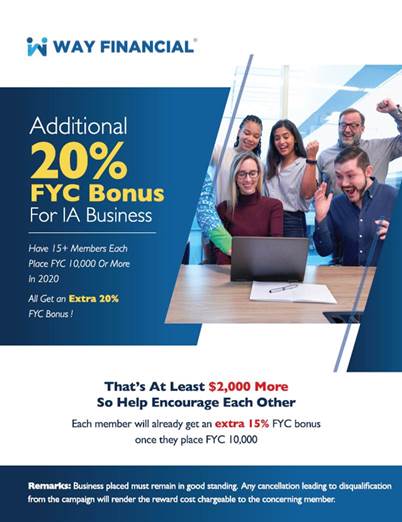

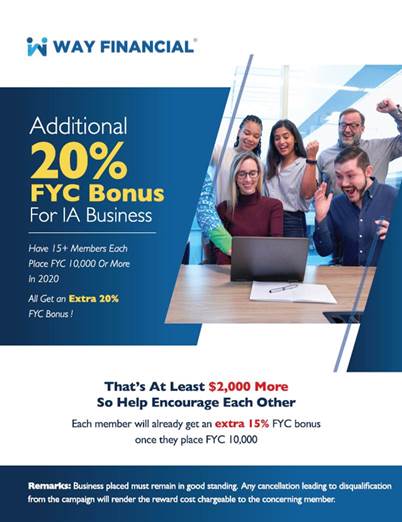

Remember, there are only 2 weeks left to the Spring Fling, and all business counts towards the CPB and additional 20% bonus this year!

Contact Rishu Bains at rishu.bains@ia.ca or (604)354-2711, or Michelle Kwan at Michelle.Kwan@ia.ca or (604)737-9154 for more info on the Par.

Investment

iA Virtual Summer Tour

Join Clément Gignac, Senior Vice-President and Chief Economist, on his new series of webinars with weekly special guests every Thursday at 8am which run until August 13th.

Webinar #2: Dividend investing in uncertain times

Time & Date: 8 to 8:30am PST, Thursday, June 25th

Guest: Donny Moss, CFA, Senior Portfolio Manager, North American Equities, iAIM

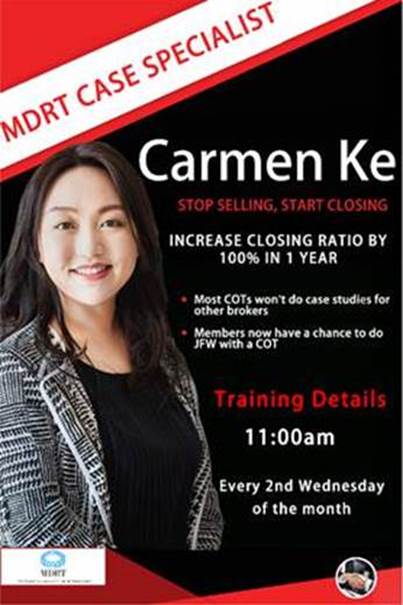

Upcoming Virtual Trainings

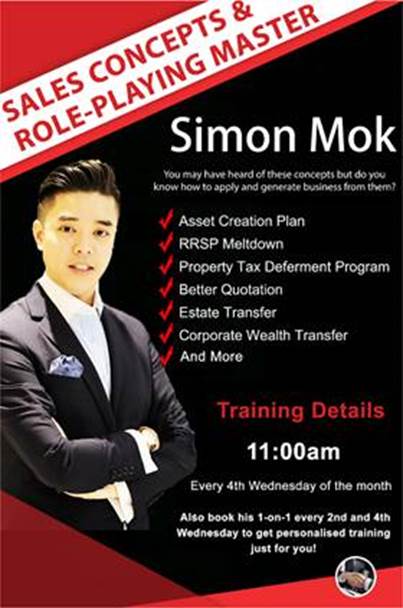

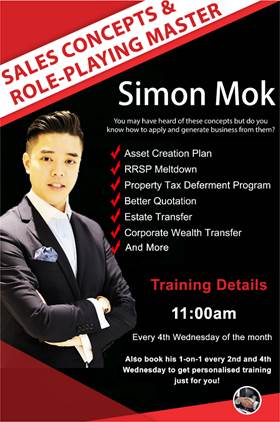

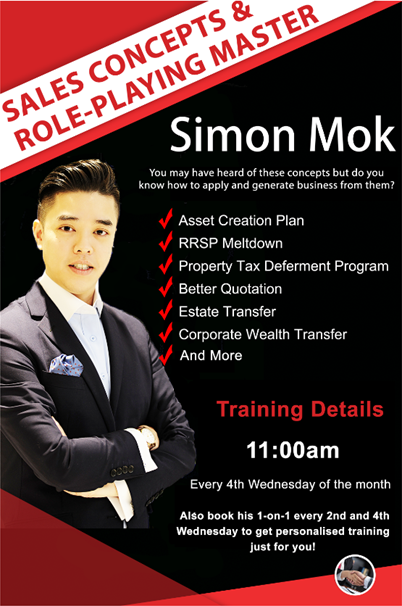

Role Play 2nd Solution and Closing – 11 Coding of Property Tax (#1 Legacy Transfer) – Simon Mok

11am, Wednesday, June 24th

\

See what top sales, Simon Mok, has to share with you this month on creating needs for clients and closing the sale.

Click on the link below to join:

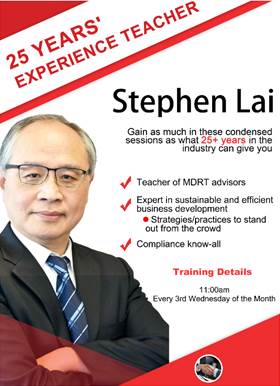

Mandatory (attendance required): 2nd Quarter Compliance Update — Stephen Lai

As part of this mandatory compliance training, you will learn new changes and requirements to the industry, as well as how to use available tools to sustain your business.

Click on the link below to join:

Capital Markets Strategy (Part 2) — ML Stefan Goddard

11am, Friday, June 26th

Learn how to follow up with your clients after the recent client webinar to immediately close new business and share insights from the capital markets strategies.

Click on the link below to join:

https://manulife-johnhancock.zoom.us/j/2025726491

Events Schedule – July (Updated)

The updated Events Schedule for July is attached for your reference.

Best regards,

Administration Department

“The WAY to connect people. The WAY to drive business.”

Way Financial Inc.

Tel: (1) 604 279 0866

Fax: (1) 604 278 0133

2nd Floor, 8171 Ackroyd Road

Richmond, BC V6X 3K1

This e-mail (including any attachments) is confidential and may contain proprietary information of Way Financial Inc. It may be privileged or otherwise protected from disclosure.

If you are not the intended recipient, please notify the sender immediately by return e-mail, and then delete the e-mail from your system. Any disclosure, dissemination, distribution or copying of this e-mail is strictly prohibited.